Qantas pilots are today launching a campaign to enlist its shareholders in their campaign against a management they say is ruining the airline.

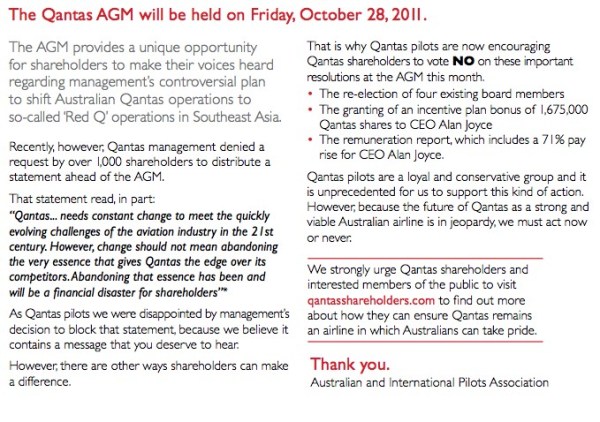

An online toolkit to help shareholders assign a proxy and vote against key motions at the Qantas AGM on 28 October in Sydney has been launched here.

This move by the pilots sets up an interesting situation.

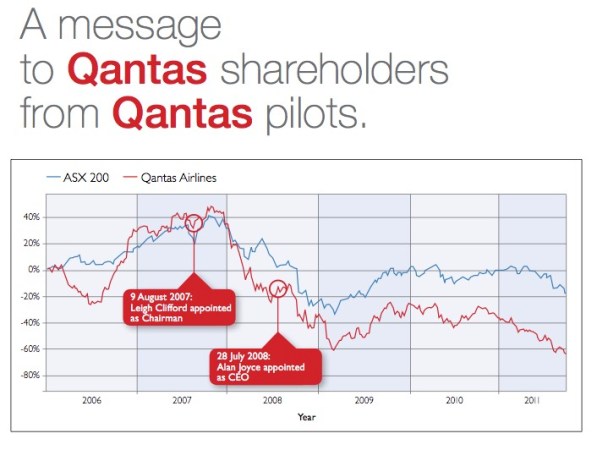

Most shareholders probably don’t care about anything but dividends and share price, which went south well before the current disputes with pilots and licensed engineers arose.

But they might well expect CEO Alan Joyce and chairman Leigh Clifford to explain just how rich how quickly the off shore strategy for a minority owned single aisle premium based Asian carrier is going to make them, after it was promised last May to metaphorically leave the gate by the end of December and start contributing to the balance sheet some time in 2012.

In a media release the Qantas pilot union AIPA says:

“Mr Joyce is determined to make Qantas workers the fall guys for the airline’s current woes. Well, we’re not playing into that. Shareholders will ultimately decide the direction of the company and we are confident that in the end they will show they don’t like Mr Joyce’s plan to offshore Qantas any more than we do.

“The two key assets of the Qantas brand are its unique Australian identity and its unparalleled safety record, built by pilots and staff. Both are under threat due to Mr Joyce’s strategy. To lose either would be catastrophic for pilots, passengers and shareholders.”

The AGM seems to be a perfect opportunity for Qantas to explain the genius in its Asia plans, and the inspiration for running down international to an operation that doesn’t even try to use all of the capacity it is entitled to fly to London.

It’s unlikely that the meeting could ever become a sounding ground for union grievances. But it is the right place to call management strategies to account.

Why does Qantas pay its top tier management more than any other major long haul airline on earth while failing to win and hold the quality end of the international market?

How much damage will be done to its frequent flyer program earnings, the strongest part of its activities, if it continues to run down international?

Just how much brand damage will Qantas do to itself in its efforts to evade the purpose and intent of the Qantas Sale Act?

These and other questions about management performance have nothing to do with union claims and everything to do with an enterprise that is failing now.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.