The last week of November is always the busiest of the year for corporate AGMs as hundreds of companies struggle to meet the deadline of completing the key annual governance event by November 30.

Most decent companies strive to avoid being associated with the last-day laggards, but there will be some big AGMs over the next six business days, as this Australian Shareholders’ Association (ASA) list demonstrates.

Critics are lining up from all sides to hop into Woolworths on Thursday, so don’t be at all surprised if the retailing giant cops its first ever remuneration strike over the generous superannuation arrangements for outgoing CEO Grant O’Brien.

However, it is another retailer, Harvey Norman, that might produce the biggest revolt of the week when its insider-dominated board comes in for some unprecedented attention at tomorrow’s AGM in Sydney.

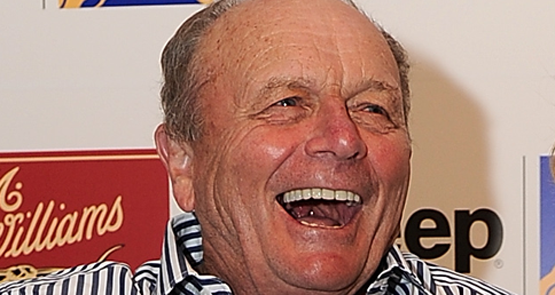

Gerry Harvey, the 76-year-old billionaire executive chairman, owns 30% of Harvey Norman, but he also has five hand-picked executive directors and only two independent non-executive directors on the board.

Very little seems to ever change at Harvey Norman, despite its shares badly underperforming against rivals such as Solly Lew’s Premier Investments, Super Retail Group, JB Hi-Fi, Retail Food Group and The Reject Shop over the past decade.

Most boards fully turn over every eight years, but Harvey Norman has gone eight years without appointing a new director to join its group of old white men (see p10 of 2015 annual report) working along with Gerry’s second wife, Katie Page, the managing director for the past 17 years.

The protest votes have been getting larger with each passing year, but tomorrow will be something new when shareholders have the opportunity to inflict a second strike against the remuneration report, thereby bringing on a vote to spill the entire nine-person board, which has served a combined 150 years.

Unlike the controlling Kirby family at Village Roadshow, at least Gerry Harvey doesn’t vote his shares on the remuneration report, and last year the company copped a first strike with more than 75% of directed proxies voted against.

However, such is Gerry’s resistance to change, when the remuneration report only received 90 million votes in favour and 282.5 million against, the billionaire failed to call a poll, and then made this ASX announcement declaring that “all of the resolutions … were duly passed by a show of hands”.

Gerry has never called a poll during Harvey Norman’s 28 years as a public company, and when I dared to ask a question at the 2000 AGM, he joked: “That’s the first time anyone has ever interrupted my AGM, I’ll get you later.”

Current finance director Chris Mentis was the last new addition to the board in August 2007, when he succeeded John Skippen as chief numbers man. Skippen went on to become the independent chairman of Slater and Gordon.

The director protests gathered steam in 2008 when three were hit by against-votes from a majority of the independent votes cast.

It stepped up further in 2009 when Arthur Brew was opposed by 25%, Chris Mentis by 24%, external lawyer Chris Brown by 13% and even Gerry Harvey himself copped a 5% protest.

In 2010 the angst shifted towards remuneration issues when the granting of 9 million options between three executive directors was opposed by more than 30% of the directed proxies. That year, Gerry’s son Michael Harvey, who was managing director for four years until 1998, also copped a 15% protest but the biggest director protest was 21% against chief operating officer John Slack-Smith.

In 2011 the only two independent non-executive directors, accountants Graham Paton and Ken Gunderson-Briggs, were supported by more than 90%, but another executive director David Ackery set a new company record for rejection with 273 million against votes, or some 31.5%.

The first year co-founders Gerry Harvey and Ian Norman weren’t able to vote their combined 46% stake (almost 500 million shares) on the remuneration report was in 2012, but it still passed relatively comfortably with almost 90% in favour. However, Michael Harvey suffered the family’s biggest against-vote of 131.3 million shares and two of the non-independent directors, lawyer Chris Brown and CFO Chris Mentis, had more than 200 million votes against them.

In 2013 more than 98% of directed proxies supported the remuneration report and independent director Ken Gunderson-Briggs, but there was a 31% protest against executive directors John Slack-Smith and David Ackery.

In 2014 a new record was set, with more than 75% against the remuneration report. While only 5% opposed Gerry Harvey’s re-election, 33% went against Chris Mentis.

The ASA is recommending against the remuneration report again tomorrow, and if institutions follow suit, there will be a second strike. That would trigger a subsequent vote on whether to spill the whole board, which Gerry would no doubt vote his 30% stake against.

Co-founder Ian Norman passed away last year, but the family’s 16.5% stake is friendly to Harvey Norman so there will be no problems defeating the board spill vote. Chris Brown, a director since 1987 and Harvey Norman’s long-time lawyer, is executor of the Norman estate.

However, Brown’s re-election tomorrow will presumably attract the usual 30% against-vote as shareholders demand more independent directors.

When you have a board dominated by insiders, independent shareholders shouldn’t be surprised by shoddy treatment. And so it was with last year’s capital raising, at which Gerry Harvey personally pocketed a $2.5 million windfall from the 8000 small shareholders who didn’t take up the discounted offer.

Here’s hoping the ASA and small shareholders also give that issue a solid workout at tomorrow’s AGM.

Out of curiosity, what do you believe the word “angst” actually means?

I am looking forward to the WOW AGM, Big W might be on the chopping block but Masters is the biggest problem in my view.

I know hardware being an old building worker and Masters are fucked.