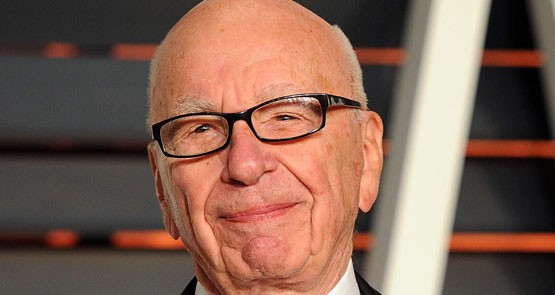

Loss looms for News Corp. There goes the third-quarter profit as News Corp agrees to pay a total of US$280 million (more than A$390 million) to stop what could have been a highly embarrassing class action after just one day of a widely anticipated New York court hearing. The class action against News Corp claimed it monopolised the market for in-store promotions in US supermarkets. Some of the biggest companies in US marketing had ganged up to pursue the Murdoch-controlled company in the action — they included Dial (soap), Kraft Heinz and Co (that’s a company Warren Buffett sort of controls), and Smithfield Foods, a giant meat group. The class action had charged News Corp with monopolistic practices around its dominance of the market for in-store promotions at retailers: coupon dispensers, displays, cart ads and other displays.

But late in the afternoon of the first day of hearings in a New York court room, rumours circulated that News Corp was preparing to settle, and a statement emerged from the company late on Monday night. News Corp said that while it “had full confidence in our case, we believe this decision is in the best interests of our company and stockholders”. The plaintiffs had been asking for US$2 billion (they had a basic ask for damages of US$674 million, which could have been trebled). News settled as quickly as possible after it saw the way the first day was going. — Glenn Dyer

Japan’s money madness. Investors will pay the Japanese government to borrow money after it sold US$20 billion worth of 10-year bonds with a negative yield for the first time ever yesterday. The sale is the upshot of the Bank of Japan’s move to introduce negative interest rates on some bank reserves on January 29 as it tries to rally the moribund economy. Market yields on 10-year bonds have already fallen into negative territory in Japan, but this changed on Tuesday when the Ministry of Finance sold 10-year bonds with an interest rate of 0.1% at the average price of 101.25, yen, producing a yield of minus 0.024% if held to maturity. That means buyers will effectively pay the government around US$25 million a year to hold the bond.

The last sale of 10-year bonds had an average yield of 0.078% in the auction on February 2, three days after the negative rates move was announced. So the yield on the 10-year bond has fallen more than 1% in the space of a month, a huge fall, and means the price of the bonds are now at record highs. Demand was strong with buyers for 3.2 times the amount sold lodging bids — or more than US$64 billion. The reporting has included lots of metaphors involving the world of that well-known economist Lewis Carroll, such as Through The Looking Glass – What Alice Saw. — Glenn Dyer

Mad bank disease. And if the ECB pushes its key interest rate deeper into negative territory at next week’s meeting, life will get tougher for banks in Europe, regardless of whether Britain votes on June 23 to leave the EU or stay. One of the reasons for the rising chance of a yes vote in Britain is the belief that the country’s financial sector will be better off than being integrated into the EU. Many businesses, large and small, beg to differ. Looking at some of the results of the big London-based banks for 2015 or the fourth quarter, the Brexit won’t matter — most are enfeebled financial giants, high-cost loss-makers just waiting for someone to blow them over, or still existing on government backing. In fact, the British banks are diseased (and all those clever “shorters” of the Aussie banks should have really been in there having a lash at the lumbering dinosaurs of the City of London, a financial fairytale world if ever there were one).

Take Barclays, supposedly a banner carrier for British banking — overnight its shares slumped 8% (over 11% at one stage) after it revealed a much bigger loss than expected 1.9 billion pounds (A$3.6 billion) for the fourth quarter and cut its dividend for 2016 and 2017, and a bigger loss for 2015 as a whole. The shares are down more than 40% over the past six months. RBS, still state controlled, lost 2 billion pounds in 2015 (close to A$4 billion) and has lost money for the last eight years after being bailed out by the UK government. Standard Chartered last month revealed an embarrassing loss for 2015, the first in 25 years of 1.5 billion pounds (close to A$3 billion). If it weren’t for the names you’d think they were oil and gas or mining after releasing so much red ink. — Glenn Dyer

Japan’s money madness

That people / the establishment and the rest, buy into something that loses money . . . .

. . . either the presses have been running for months, manufacturing the payment

. . . the buyers were made an offer they can’t refuse

OR

. . . . (your thought)