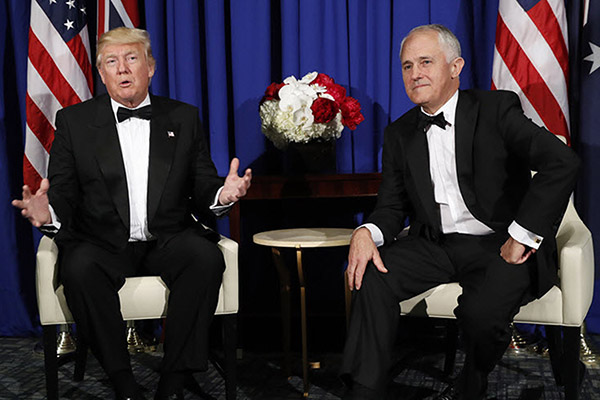

The Business Council of Australia (BCA), and its proxies in parliament, currently find themselves closely aligned with US President Donald Trump in making the case for massive tax cuts: US$2.4 trillion over 10 years in the case of Trump, and over $60 billion over 10 years under the Turnbull government’s tax-cut plan. Neither are funded, although the Republicans are looking for tax breaks to close down to provide some offsetting savings.

Both Trump and the Turnbull-big business alliance here insist that the benefit of the cuts will primarily flow to workers through growing wages, stronger employment and higher economic growth. That’s despite real-world evidence that, to the contrary, corporate tax cuts mainly benefit shareholders and corporate executives. The Trump tax-cut agenda has prompted some key institutions and highest-profile economists to challenge the claims being made by Trump and the White House about the claimed benefits of massive tax cuts for the world’s biggest companies. Here’s a sample of how the US debate has proceeded in recent months.

- The pro-big business Wall Street Journal reported that a 2012 US Treasury paper — which demonstrated the bulk of the incidence of corporate tax falls on companies, not workers — was removed at the instruction of Trump Treasury Secretary Steve Mnuchin. The Treasury study confirmed a Congressional Budget Office study that similarly concluded any benefit for workers from a corporate tax cut is far smaller than claimed. In Australia, the BCA consistently tries to argue that, similarly, Australian workers will be the beneficiaries of a company tax cut.

- The Tax Policy Centre’s analysis of Trump’s plan warned it would cost $2.4 trillion and generate no sustained increase in economic growth. It conducted two separate analyses using different models; its own modelling showed the package “would boost economic growth for the first few years but slow the economy after that” while using different modelling found it would “result in small increases in growth from 2018-2027 and slow the economy in the following 10 years”.

- Trump’s council of economic advisers published a report using modelling from academics showing gains of US$9000 per household. One of the academics, who supports corporate tax cuts, pointed out that the paper misinterpreted his modelling and that benefits would be a maximum of $800 a household. The academic was then accused of not understanding his own paper.

- Clinton administration economist and IMF adviser Robert Shapiro pointed out US Treasury work that showed significant cuts in the effective corporate tax rate in the United States from 2007 to 2011 had failed to spur significant business investment or wages growth.

- A Republican state senator from Kansas urged Congress not to repeat the mistake her state made in cutting taxes in the belief it would stimulate economic activity.

- Warren Buffett — while admitting a corporate tax cut would be good for his investors — rejected the argument that a tax cut would spur investment. “We have a lot of businesses … I don’t think any of them are noncompetitive in the world because of the corporate tax rate … I do think some of the arguments, I think some people may find their nose growing a bit after they make them.” Billionaire entrepreneur Mark Cuban agreed, saying “Amazon is going to affect a whole lot more companies and futures, as will Microsoft and Facebook and Google and other big companies, a lot more than a marginal tax rate.”

- CEOs at a Wall Street Journal conference with Trump’s economic adviser Gary Cohn embarrassed him when the majority indicated they wouldn’t use the Trump tax cut for additional investment, confirming media reports that CEOs were openly saying they would use the tax cut for share buybacks.

Crikey is committed to hosting lively discussions. Help us keep the conversation useful, interesting and welcoming. We aim to publish comments quickly in the interest of promoting robust conversation, but we’re a small team and we deploy filters to protect against legal risk. Occasionally your comment may be held up while we review, but we’re working as fast as we can to keep the conversation rolling.

The Crikey comment section is members-only content. Please subscribe to leave a comment.

The Crikey comment section is members-only content. Please login to leave a comment.