Gee, aren’t they a clever lot behind the merger of Fairfax and Nine (with their cheer squads in the Financial Review, SMH and Age): ignoring history and attempting to recreate the old debt-ridden Fairfax empire, before Warwick Fairfax, his mother and a team of incompetent advisers blew it apart in the ’80s.

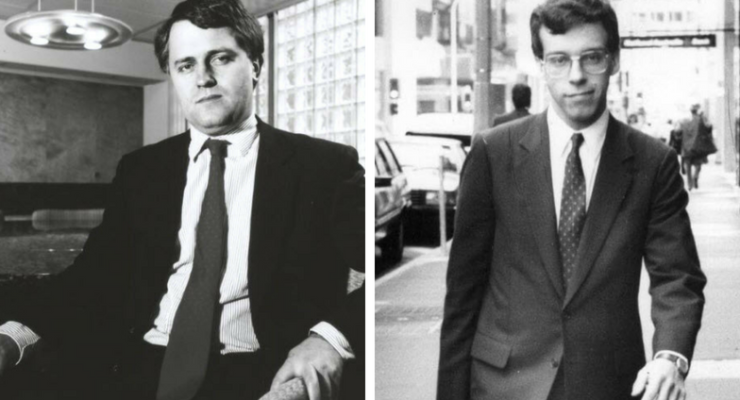

Warwick’s adventure at the helm of the company ended in disgrace and financial disaster, exploited in part by the ambitions of a then-Sydney lawyer, Malcolm Turnbull. What has changed at Fairfax since the ’80s to make it any more valuable? The board and managers, led by departing CEO Greg Hywood have cut and cut and taken their bonuses and millions of dollars in options and shares and left nothing.

A careful reading of the history of Australian media mergers and takeovers is that the highest value is always on the first day and slides from then on. This deal between Nine and Fairfax Media will be no different — the wagon train is drawing in an even tighter circle to ward off the raiders, but the passengers are slipping away every hour to the lure of lusher pastures. These deals destroy value because it is all about protecting the fortunes of moguls or insiders, not the position of employees or customers.

Remember the creation of Kerry Stokes’ pride and joy, Seven West Media? A $4.1 billion company back in 2011, it was a $1.3 billion company yesterday and just over $800 million a couple of months ago. Alan Bond’s takeover of Nine 25 years or so ago was a disaster — Nine ended up in the hands of bankers, then back to Kerry Packer’s, and then sold off by James Packer, saved only by a couple of risk-taking American hedge funds and private equity groups. So don’t believe anyone who says this is a good deal. There are no winners, the inevitable is merely being postponed.

Years of indulgent management, self-congratulation, sucking up to governments both Liberal and Labor (and look who will chair the merged company, good old Peter Costello). What has been the strategy of Nine and Fairfax as online giants encroach? Ignorance, alarm, and just one idea — the Stan streaming service — and then blaming the ABC and SBS for being more adept in the online world. While Google, Facebook, Netflix and others took viewers, customers and business, Nine and Fairfax whinged to the government and tried to neuter the national broadcasters.

So what did investors think of the idea of the resurrection of the old Fairfax Media empire by Nine Entertainment? Well investors in the end didn’t care very much. The consensus is that there won’t be a counter bid — Kerry Stokes’ Seven West Media was spurned by Fairfax and has too much debt. Private equity kicked the tyres last year and found Fairfax unappealing. Fairfax shares were up around 12% after the merger announcement, a day’s high of 88 cents, but then eased back to close up 8.4%. Domain shares saw a bigger rise — up 9.12% as punters reckoned, wrongly that it could be sold.

Nine shares were sold off, as was expected — it’s making the bid and spending half a billion or so in cash. Shares ended the day down 10.3% at $2.26 and touched a low of $2.24. Nine is recreating the elements of the old Fairfax family controlled empire by taking on more debt, boosted to around $600 million — levels similar to those at Seven West Media. Peter Costello and Nine CEO Hugh Marks are ignoring that Seven West Media precedent — $4.1 billion at creation, $1.3 billion now. Value destruction has been a hallmark and there is no reason to think that the merged Fairfax and Nine won’t travel the same route. This proposed marriage is built on fear, not romance.

Doesn’t Mal look the epitome of the 80’s smart arse yuppie prick .

ADDIT- only in the musically sense of course Chairman Mal 😉

https://youtu.be/bTS-HYFz0MA

What sort of “productivity” did Hywood achieve?

Enough to buy a Maserati. Bugger the workers.