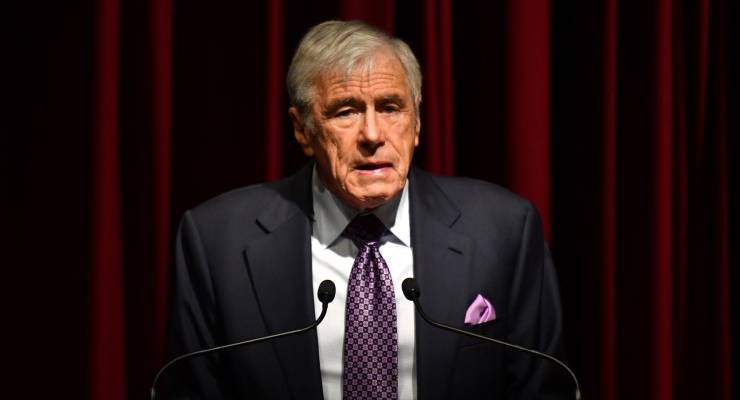

At a time when traditional media stocks are under the pump, you would think that billionaire mogul Kerry Stokes would be prioritising supporting his debt-laden Seven West Media.

But no, Stokes hasn’t injected a dollar into Seven West Media since a recapitalisation proposal in April 2015. Meanwhile, last week it was revealed his 61%-owned industrial conglomerate Seven Group Holdings had spent close to $350 million amassing a 10% stake in battling building products group Boral.

If Stokes isn’t prepared to recapitalise Seven West Media, which has a share price wallowing at around 17c, then his Seven Group Holdings should surrender control and sell its 40% stake.

When Stokes first raided the WA News share register in October 2006, he paid $11 a share amassing a 14.9% stake. He then crept up the register and eventually seized board control in December 2008 when he became chairman after the incumbent directors resigned en masse despite Seven only controlling 22.5% of the shares on issue.

It was quite a resources industry takeover as the new WA News board included then Woodside Petroleum CEO Don Voelte and Rio Tinto’s iron ore boss Sam Walsh.

From that day on, there has rarely been a negative story in The West Australian about the mining industry — given the paper is controlled by one of the state’s biggest resource industry moguls. It was a conflict of interest that has never been adequately managed and remains to this day.

And speaking of conflicts of interest, Stokes has been involved in two of the largest and most controversial (though fully disclosed and within ASX requirements) related party transactions completed by Australian public companies, the reverberations of which are still being felt.

These were triggered by his decision in November 2006 to sell a 50% stake in his media empire to private equity firm KKR in a deal which valued the businesses at $4 billion and involved KKR injecting $735 million of equity, with the balance of the funding coming from a $2.5 billion debt facility.

However, when the GFC struck in 2008, Stokes found himself carrying debts of more than $1 billion in his private company, primarily supporting his WesTrac business which has boomed from having the WA franchise to sell and maintain Caterpillar mining equipment.

In 2010, the ASX listed Seven Network agreed to buy WesTrac for $2 billion, creating a messy debt-laden media and industrial conglomeration which had to manage the duel challenge of Stokes remaining a media mogul and KKR securing a profitable exit from its media joint venture.

The solution was a now notorious related party transaction where Seven Network sold its television and magazine assets for a ridiculous $4.1 billion to the old WA News in April 2011, facilitating a profitable exit for KKR.

WA News was renamed Seven West Media and for minority shareholders, this has been a slow moving disaster ever since, while Stokes’ other investments have boomed.

Fast forward a decade and media investments, primarily the 40% stake in Seven West Media, now comprise a meagre $100 million of the assets owned by Seven Group holdings which is a $6 billion conglomerate spanning WesTrac, Coates Hire, some oil and gas assets and now a 10% stake in Boral.

Given the ugly memories of Seven West Media’s performance and the confusion of having two listed companies called Seven, it is time to tidy up this situation. A sensible start would be renaming Seven Group Holdings at the upcoming AGM. Why not just call it “Stokes Group Holdings”.

If Stokes wants to keep calling it Seven Group Holdings then it should buy the remaining 60% of Seven West Media that it doesn’t own, putting minority shareholders out of their misery.

As for what happens with Boral, Stokes will do his usual creeping up the register followed by a request for a board seat. He is effectively Australia’s most prolific shareholder activist who wins far more than he loses, but rarely makes a full bid for control.

However, the minority shareholders in WA News ended up being enormous losers and they shouldn’t have to suffer ongoing losses with the billionaire in control of their business while not prepared to inject any more capital or increase his stake in their hour of need.

Instead, Stokes is busily shrinking his media empire, selling off Seven West’s magazine division to Bauer Media for $40 million last month, and even doing a sale and lease back on the old WA News headquarters at Osborne Park in Perth, a move which brought in $75 million.

These two deals have raised $115 million in much-needed cash over the past month, reducing Seven West Media’s net debt, which was last publicly disclosed as $541.5 million in February, to below $500 million for the first time in a decade. It peaked at more than $2 billion in 2011 as these accounts from August 2011 show when the group claimed it had assets worth $5.1 billion and net equity of $2.51 billion.

The latest Seven West Media accounts reveal net assets of just $20.8 million and accumulated losses of $3.4 billion, yet the bloke responsible for this has been chairman for 12 years and is now 77.

It is time to either give someone else a go, or put the minority shareholders out of their misery by announcing a mop-up bid — something which could have been funded by the $350 million diverted into Boral shares over recent months.

The sooner commercial media goes broke the better for Australia, the wankers at 2GB preaching to the wanking public is something no civilized society needs as its a gross insult to the intelligent thinking people, there will always be a brain dead section of any society but it does get embarrassing when it’s exposed to the world via Facebook, etc, these ignorant redneck types are not meant for public viewing but should be kept away from the spotlight, using the U.S as an example, its gone from being a respected world power to a demeaning world joke and is seen as a nation of gun-waving hillbillies so stupid they can’t even get a 3rd world health system in place, in comparison to China the U.S is now the Beverly hillbillies society and seemingly proud of their dumb president Jed Clampet Trump.

” Jed Clampet Trump” rofl.

Is there a business model anywhere in the world where shareholders buy a media outlet to create an independent and balanced service that has the general public’s best interests at heart, how could it be funded? It’s hard to watch whats happening to Aunty or the Age.

Are there enough small businesses out there or large ones for that matter that would benefit from advertising from an outlet that had balanced discussion and ethical [including advertising] standards and this could benefit their brand by association?

The Packer/Murdoch/Stokes model still has massive and/or historic influence on the public and therefore politics even if the more obvious revenue streams are drying up, an independent outlet could place further pressure upon them.

Every subscriber here would have a vested interest in buying shares, that being the general mental health of the country.

The nature of bidding on a company is to raid them to beat the share price from skyrocketing,..I think,.. how do you crowd fund without tripping the alarm?, neocons maybe so comfortable they don’t believe its possible,… start buying shares in 7 as sleepers?

Out of my depth here…ha.. build a war chest? an annual or quarterly ballot type jury for oversight?

A fault line seems to be emerging in the neocon way of influence, too naive and idealistic summation folks?