Attacking the Murdoch family is a pretty popular pursuit in Western democracies right now — which is why former prime minister Kevin Rudd’s reputation and popularity has enjoyed a solid lift recently.

With the implosion of Donald Trump, Brexit costs spiralling, climate denialism on the way out and Boris Johnson looking less credible with every passing day, there aren’t too many loopy Western political projects left for the Murdoch family to back.

Rudd made a smart play with his official parliamentary petition calling for a Murdoch royal commission, and his latest push to encourage a boycott of the ASX-listed and News Corp-controlled REA Group is also drawing plenty of attention.

However, truth be told, the share price performance of REA Group is completely immaterial to the Murdoch family which enjoys total wealth in excess of $30 billion.

Bloomberg publishes a live ranking of the top 500 global billionaires and as of last night it had placed Rupert Murdoch the individual at 315 with a net wealth of US$7.4 billion (A$9.7 billion). He trails six other Australians, namely Gina Rinehart (US$27.2 billion), Twiggy Forrest (US$20.2 billion), the Atlassian twins Scott Farquhar and Mike Cannon-Brookes (US$14.6 billion each), Harry Trigaboff (US$9.7 billion) and Anthony Pratt (US$7.68 billion).

However, this Bloomberg valuation is seriously underdone in terms of the wider Murdoch family, particularly Rupert’s six children who range in age between Chloe at 17 and Prudence Macleod at 61.

As was noted in this Crikey piece back in April, Forbes magazine valued the Murdoch family at $24 billion in its 2020 rich list. Each of the children are worth at least $2 billion courtesy of their share of the nearly 10% stake in Disney which the family reportedly inherited when Fox’s entertainment assets were sold to Disney in a $93 billion deal that closed in March 2019.

Sure, REA Group was valued by the market at a staggering $19.35 billion last night, meaning News Corp’s 61.6% stake is worth a tidy $11.9 billion. But when you consider that the Murdoch family owns only about 16% of the total News Corp shares on issue (remember a gerrymander gives them about 40% of the votes), this equates to direct family wealth of only $1.9 billion.

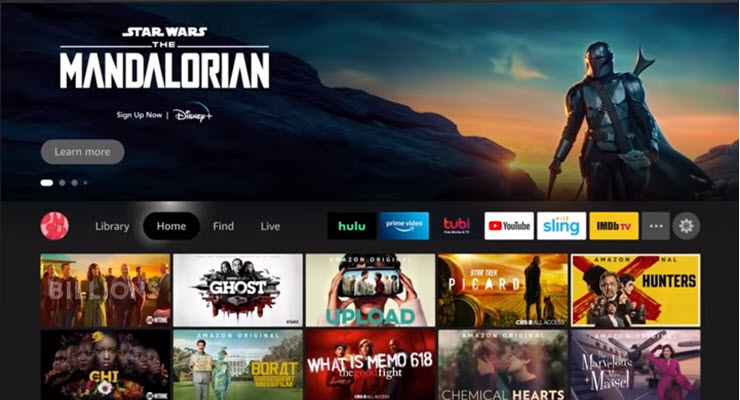

Last Friday night, Disney shares rocketed 14% after the company produced a better than expected quarterly result, with investors becoming particularly excited about the 73 million global subscribers to Disney+.

The shares have continued to rise and hit a record high of US$173.94 yesterday, valuing the company at a staggering US$314.9 billion.

If the Murdochs have really got almost 10% of Disney spread between Rupert and his children the REA is a mere rounding error — but it is seemingly impossible to get a straight answer out of Disney about precisely how many shares the Murdoch family own.

Three separate inquiries to the Disney press office this year have yielded nothing and the 2020 Disney proxy statement also gives no clue, given it claims index giants Blackrock and Vanguard are the only two shareholders with more than 5%.

The bottom line here is that the best way to hurt the Murdoch family financially would be if Disney went broke because it owns at least $15 billion worth of shares, despite having zero influence through board representation.

So if you want to boycott the Murdochs commercially, don’t subscribe to Disney+, or pay to see any Marvel or Disney movies — let alone visit its theme parks or take a Disney cruise.

Paradoxically, REA and Disney are the two businesses which probably attract the least amount of Rupert Murdoch’s attention because neither satisfies his unending desire to wield power over Western governments.

He wouldn’t give two figs if Rudd inflicted commercial damage on REA, provided that Fox News was continuing to shape the conservative agenda in the US, The Sun was delivering Brexit in the UK, and his Australian outlets were fighting the good fight against green-left causes such as climate change and the ABC.

That said, the booming REA is certainly cross-subsiding News Corp’s shrinking Australian media empire, but if it was suddenly gone — such as through a distribution of the 61.6% stake to all News Corp shareholders — the family could very easily afford to take the rump of News Corp private and run it as a family-owned influencing outfit.

Ultimately, the way to fight Murdoch power is to push for Rupert to surrender the executive chair position he holds at News Corp and Fox. Once he is gone — and he turns 90 on March 11 — it’s unlikely his eldest son, Lachlan, would successfully hold the empire together.

I think he probably does give two figs what Rudd is up to, otherwise those recent editorials and ‘gotcha’ moments in his ‘news’ publications wouldn’t have appeared. Rudd is doing his thing, like a pesky fly you keep swatting that won’t leave you alone. I like his strategy, who know how far Rudd intends going with this? I’m happy to see where he goes and support as I can along the way.

Rupert Murdoch the individual at 315 with a net wealth of US$7.4 billion (A$9.7 billion). He trails six

otherAustralians, ….Remember, dear old Rupert is an American not an Australian.

Unlike Mr Mayne to make this missstatement subediting never got a chance online and has been dead for years in print, so sad. On the other hand lovely to see irony flourishing: dear, yes; old. VERY.

No, the Rodent changing the Australian citizenship rules to allow Moloch to reapply – which he promptly did.

Lachlan is a dual citizen of US & Oz.

It would be heartening were Lachlan unable to keep the Evil Empire running as you suggest.

However, by all reports, he is an even nastirer piece of work that his father.

He could do something exceptionally nasty even with the rump organisation.

Try unsubcribing from Foxtel. It usually takes up to 45 minutes, as they’re throwing everything at you to keep you.

It very satisfying doing it.

And yhe Oz having the gall to charge $50 a month!!!!! Crikey and NewsDaily combined is far better reading!!

This seems misguided, unless we’re also pushing the line that Disney’s output is somehow influenced by Murdoch and that’s why we need to boycott it?

Would this article hold up if it was ‘Murdoch owns Woolworths shares, time to crash their stock price and bring him some pain”, etc?

No, of course not. We should crash Woolworths’ stock price anyway because of their attempt to booze up indigenous communities and their holding pokies licenses for two decades. Yeah, I know they’ve divested the latter, but they still deserve punishment for having bought them in the first place.