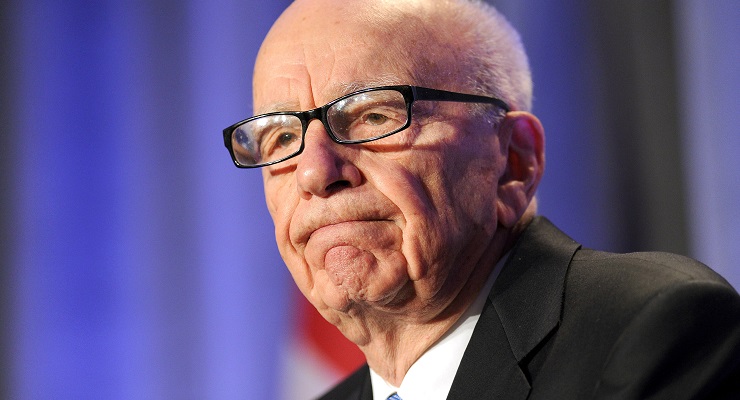

Rupert Murdoch has overseen hundreds of corporate transactions since inheriting control of Adelaide-based listed company News Limited in early 1953 at the tender age of 22.

More than 67 years later, the world’s longest-serving public company CEO turned 90 on March 11.

The old fella isn’t slowing down. He’s going harder than ever, unveiling three separate acquisitions over the past week which will together cost $1.07 billion.

Surprisingly, none of them are related to the Murdoch family’s core newspaper and television businesses. Although print received some attention with the $460 million purchase of book publisher Houghton Mifflin Harcourt — a deal which will add 7000 titles to the Harper Collins back catalogue, including the Lord of the Rings trilogy and George Orwell’s Animal Farm and 1984. That sparked a special tweet from Rupert’s latter-day chief critic, Kevin Rudd.

Four days earlier, News Corp announced the $362 million purchase of Investors Business Daily, a US-based tip sheet which runs investors.com and has almost 100,000 digital subscribers.

These two deals will drain $822 million from News Corp’s cash balance, leaving it with a net debt position for the first time since it de-merged 21st Century Fox in 2013. The December 31 News Corp balance sheet disclosed that net cash was down to just US$306 million.

News Corp’s biggest asset is its 61.6% stake in REA Group, owner of the lucrative realestate.com.au advertising business in Australia. And on Tuesday, REA announced an agreed $244 million takeover of Mortgage Choice. It’s an expansion into the mortgage broking market that should be heavily scrutinised by the Australian Competition and Consumer Commission (ACCC) given the company’s enormous market power in the Australian real estate space.

REA is today capitalised at $18.4 billion, meaning that News Corp’s controlling stake is worth a staggering $11.3 billion. It has been the single best public company takeover on the ASX considering that News Corp is sitting on around $11.2 billion in unrealised capital gains since its original $10.75 million purchase of a 44.2% stake in November 2000 after the tech wreck. This was followed by a top-up takeover bid priced at $2.25 in 2005-06 which cost it about $45 million to move to 61.6%.

Given that the Murdoch family and News Corp in particular is being so expansionary at the moment, it remains puzzling why it has made such a massive voluntary retreat from the Australian newspaper market. News permanently closed the print editions of more than 100 regional and suburban Australian titles last year.

This move has created news deserts in large segments of Australia, an issue that arose at the recent City of Manningham community engagement panel, where residents deliberated on the strategic priorities for council over the current four-year term. Many of them lamented the disappearance of News Corp’s The Manningham Leader.

When I served an initial four-year term on this council in Melbourne’s eastern suburbs from 2008-12, The Manningham Leader delivered a broad cross-section of news for free each week to the council’s 50,000 households.

We doubled our advertising spend to help keep it going, but over time the journalistic resources were cut and distribution was reduced to service stations, cafes and newsagents. But at least it was still coming out on weekly basis until June last year, holding the council to account and informing the community on what was happening.

There is growing consternation about local government news deserts in Australia, so much so that City of Manningham is putting up the following motion to the upcoming Municipal Association of Victoria (MAV) state council meeting to be held at Melbourne Town Hall on May 21.

That MAV explores the feasibility of extending its current sector-wide procurement offerings to include production and distribution of free weekly, fortnightly, monthly or quarterly newspapers in light of the significant increase in LGA [local government area] news deserts across Victoria following the decision by News Corp last year to cease printing most of its suburban and regional newspapers across Australia.

The supporting background to the motion being distributed to MAV voting delegates includes the following:

Australia’s biggest newspaper company, News Corp, ceased printing most of its suburban and regional newspapers last year, creating an increased number of news deserts across metropolitan Melbourne and adding to the already large number of news deserts in small towns across Victoria. Some of News Corp’s Leader Newspapers suburban titles were retained in a limited online form, but a majority of the journalists covering council issues were retrenched or redeployed.

Where there is interest from a council to resurrect a print version of their defunct Leader newspaper, a cornerstone advertising contract would be the obvious starting point. MAV is best placed to enter into negotiations with News Corp and any other newspaper provider to try and secure positive outcomes for MAV members concerned about the impact of news deserts on their operations.

One option might be MAV buying or being paid to take on a 49% stake in Leader Newspapers on the condition that print services were resumed in the metropolitan council areas where there was demand and interest.

Given how important cross-promotion in News Corp’s huge stable of newspapers was for the development of realestate.com.au over the past 20 years, you would think the Murdochs would see maintenance of their print empire as a justified loss-leader.

Sadly it seems that they just don’t care about these communities, preferring to expand further into the gambling industry rather than sticking with their core newspaper knitting.

Note: Stephen Mayne is a City of Manningham councillor.

Have you been impacted by the loss of suburban and/or regional newspapers in your area? Let us know by writing to letters@crikey.com.au. Please include your full name to be considered for publication in Crikey’s Your Say section.

Related, how did NewsCorp, LNP and legacy media, in their shakedown of Big Tech on ‘journalism’, avoid being challenged on their significant interest in REA, formerly part of their ‘rivers of gold’ paying for journalism which they now claim is unaffordable?

Also ignores how constraints on media audience cross channel reach, penetration etc. have been relaxed in a supposed need for supporting NewsCorp, 9F etc.?

Hardly matches their supposed libertarian economic ideology when relying upon the state for socialist business protection?

Murdoch may be alive, but his soul is dead.

Technically, Murdoch is non-executive chairman, but he’s certainly the longest serving, particularly in the agricultural sense of the word.

The loss of local papers to hold councils to account is a serious problem.

Too many Councillors are more interested in using the gig as a platform to get into a cushy state or federal government seat instead of dealing with local issues.

The nominated officers often don’t even return Councillors’ calls, let alone meaningfully answer their questions. With the drop in external scrutiny comes a cavalier and unanswerable culture.

It doesn’t help that the Council CEOs approve Councillors’ expenses – especially the ubiquitous “study tour” boondoggles.