As once-was-Facebook Meta sees its advertising revenues start to slide, it looks like the company is sliding out of the commitments it made to pay publishers for posting their news stories in its rarely used News tab.

This will hit Australia’s masthead News-Nine duopoly, who have relied on the payments from Meta and Google to sustain profits to their parent companies as they attempt to pull off the transition from being mass ad businesses to ones targeting their audience for subscriptions.

Just last year, mid-pandemic, Meta seemed like a money pit. As it rose rapidly through the top 10 global companies, getting old media (with its enduring political clout) off its back was one of the platform’s top 10 problems. Not anymore.

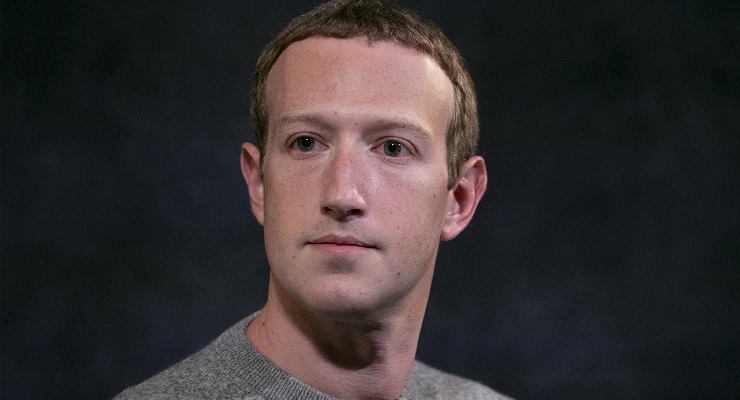

Then, tossing a few millions at old media to make them go away must have seemed good business. Now, the company is struggling, its shares down 60% on its last September peak as the market grasps the core truth: Meta’s money-making platforms — Facebook and Instagram — have suddenly, shockingly, lost the attention wars to TikTok, especially among the younger demographic that advertisers are so eager to reach.

This makes the latest Meta pivot bad news for old media, with reports out of the US over the weekend that the tech giant is not renewing the three-year deals it reached to pay US publishers — including News Corp’s Wall Street Journal — for posting stories in the News tab.

Instead, it’s getting out of news, with reports in last week’s Wall Street Journal that the platform’s head of digital journalism services, Campbell Brown, had told her team that the company was “reallocating resources” from (that is, closing down) the News tab and its newsletter platform Bulletin (launched a year ago to compete with Substack) and shifting to the “creator economy” (that is, TikTok-style video).

On the weekend, political news site Axios broke it down to dollars: Meta has paid about 50 US publishers about A$150 million since Mark Zuckerberg’s “fireside chat” announcement with News Corp CEO Robert Thomson in October 2019. The big winners in the US have been The New York Times (about $29 million) and The Wall Street Journal (about $15 million).

Last year, Meta agreed to pay Australia’s old media “commercial-in-confidence” amounts to include local content in the News tab (which has had limited rollout in Australia) to prevent the company being brought under the news media bargaining code (legislated by the Morrison government at the urging of publishers).

Last August Meta also announced a $15 million three-year grants program for regional and independent media.

Now, there’s no tab. And not much news. Instead, Meta is mixing up its Facebook feeds to fight off the competition with TikTok, splitting the core feed into two: family and friends delivered chronologically and one that attempts to mimic the highly addictive TikTok with “recommendations” — content from people you are not “friends” with. (Zuckerberg said last week that recommendations will be 30% of the feed by next year.)

On Instagram, the shift to full-screen video recommendations in place of Insta-square-sized photos from people you follow is driving a revolt among users, including the high-profile influencers (even, gasp, a Kardashian!) who have built the platform’s reach.

The revolt forced a short-term walk-back by Instagram head Adam Mosseri late last week, but it came with a warning: sure, we might have moved too fast — but we’re going to keep breaking things.

Meanwhile, Meta is struggling to make money out of its metaverse strategy. While last week’s quarterly report showed the company still making good (if declining) money out of its “family of apps” (Facebook, Instagram, WhatsApp) it lost a net $8.3 billion from its Reality Labs in the first half of the year.

That’s driving an unusual focus on the cost side of the business, with Zuckerberg foreshadowing significant staff cuts over the next six months.

The platform is also at war with European regulators, threatening to reprise its Australian play by pulling services out of the EU.

This month, Australia’s old media will release their FY2022 results. These are expected to confirm what the past year’s interim results have shown: their old mastheads have become profitable off the back of the “licensing fees” being paid by both Meta and Google for publishing news in their respective tabs.

How much longer can they rely on that revenue?

Private Media, the publisher of Crikey, has a news content licensing agreement with Facebook.

Sounds like it will be bad news for Murdoch too, so two for the price of one. Champion result.

Zuck’s muck failing? A thing greatly to be desired – if only! Oh, be still, my beating heart.

Patience, Huginn. To paraphrase Paul Keating, let’s enjoy Zuckerberg being done slowly.

Zuckerberg’s news ban backfired on him in my case. I now get my news from Twiiter and hardly rely on facebook.