The most important part of the Productivity Commission’s interim 5-year Productivity Inquiry: Key to Prosperity report isn’t its argument that only a productivity rise will deliver higher wages. And it’s certainly not the claim — risibly championed by The Australian Financial Review‘s John Kehoe — that wage stagnation doesn’t exist because you can buy a better iPhone with your falling real wages.

It’s to be found on the bottom of page 15 where the PC, reluctantly, admits “what determines who — business owners, workers or consumers — get the benefits from productivity growth over time is complex … with respect to wages, at least in the near term, factors such as the relative bargaining power between business owners and employees, and the institutional and regulatory settings that govern these interactions, are important. The extent to which the gains from productivity growth are passed on to consumers (through lower prices) is a function of market structures, both in input and output markets.”

The PC’s heart isn’t really in it, but at least it has raised a core point that should undercut the government’s insistence that if only we get productivity moving then wages will grow. Labor, of all people, should really know better. Because over the past decade, productivity growth has way outstripped wages growth — meaning employers have taken nearly all the benefits of greater productivity.

The PC and the Reserve Bank like to cheat a little and push their productivity v wages graph back to 1960, suggesting a long-term growth of wages over productivity. For those of us who weren’t born in 1960, that’s not especially helpful. Much more useful is Saul Eslake’s graph commencing in 2000 (for that socialist group, the Australian Institute of Company Directors) which shows “real wages have grown much less rapidly than labour productivity — irrespective of whether real wages are viewed from the perspective of employers (deflating nominal wages by a measure of the prices of goods and services produced) or employees (deflating nominal wages by a measure of the prices of goods and services consumed).”

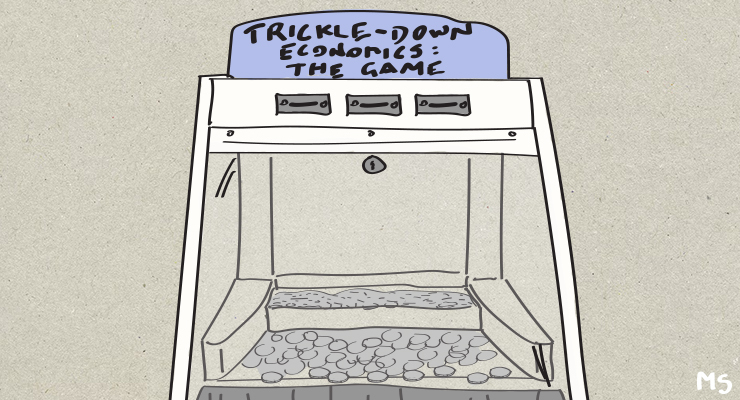

In the absence of changes to bargaining power, institutional and regulatory settings, higher productivity won’t lead to higher wages — just to even higher profits, which as a share of national income have surged in recent years. Anyone up for being more productive simply to increase your boss’s profits?

As for whether productivity benefits are flowing to consumers, that indeed depends on market structures. And Australia has highly concentrated market structures — such as what we’re seeing in the energy industry, or the financial industry, or the aviation industry, or communications, or media.

All the evidence is that far from the absurd idea that consumers are enjoying a wonderful era of benefits from productivity, market concentration is enabling firms to push prices up to increase profits. The current US June quarter reporting season has some clear examples.

Nestle, the world’s biggest consumer goods group (with annual sales of more than US$100 billion) revealed last week that “organic growth reached 8.1%, with real internal growth (RIG) of 1.7% and pricing of 6.5%”. So actual volume growth was a fraction of the 8.1% rise in quarterly sales, with the rest coming from price rises. Nestle’s profits went down — not because of input price rises, but due to one-offs like taxes. It expects earnings per share to increase even further over the rest of the year.

Procter & Gamble lifted sales 7% in its June quarter off a 1% fall in sales volumes. It reported a 7% increase in earnings per share — though that disappointed the markets, which expected it to lift prices even more.

Kraft Heinz lifted sales 10.1%, driven by price rises of 12.4%, and reported a big net earnings outcome compared with a loss last year. Unilever reported sales growth 8.1% off 9.8% price increases, fuelling a rise in profits to €5 billion.

That is, the world’s biggest grocery manufacturers are lifting prices and maintaining or increasing profits while doing so. But eventually the price rises will crush sales volumes and force them into wholesale job cuts to further protect profit margins. Workers will bear both the burden and the blame for the cuts.

This is just anecdotal, of course. But we know there’s hard evidence from the European Central Bank of business profits driving inflation across the European economy.

Let’s give the PC — which usually isn’t good at thinking about how power arises from economic structures — credit for actually noting that productivity increases won’t magically lead to wages growth and lower inflation; the power of corporations can redirect them into profits and away from households. The Reserve Bank appears oblivious to that, and can only punish households and small business through higher interest rates.

If we keep thinking in such terms, on the other side of the inflation hump we’ll just be back to wage stagnation and an ever-growing profit share of national income — just the way corporations like it.

Have your wages gone up lately? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

Why is the obvious delusion from which economics suffers not more notorious. It is utter bulls*t that business can ever be relied upon to do social good unless the consequences are negative for profit. But that delusion has underpinned policy for decades. Bring back the general right to strike!

In other words, if you are a worker, join the Union. Divided we fall. Fell.

How is it that it is always businesses can’t afford to pay pay rises, but are silent when landlords demand higher rents, toll road owners raise tolls, energy providers raise energy prices and banks raise fees and interest rates? These are all ok rises and are absorbed. but wages, oh no, can’t afford.

When I hear “‘we need to improve productivity” to afford higher wages, I have an extreme urge to vomit. We have had plenty of productivity rises, but it all goes to boosting profits, bonuses and dividends.

What hope has an employee got asking for a wage rise (which they are told to do) when they are up against a board where the board fees for even one director sitting on his or her bum once a month, is paid more than the employee? When the executives are hanging out for their $1m plus bonus if they cut costs? When shareholders demand ever increasing dividends while they sit on their bums with their hands out waiting for their dividend?

While I’m at it, I can never understand why an investor sitting on their bum gets a 50% cut in tax, while the worker putting in hard labour has to pay the full tax amount..

Any discussion on productivity also needs to include how our property sector impacts business overhead costs. Rental factors, compared to overseas, are hideously expensive and inflexible . It is possible to pay higher wages and and still manage workforce expenses with a productivity solution. However high rents, long leases, fixed annual increments and third line forcing on utility & services costs leave no or little room for productivity improvement. If you want to look for examples of talentless management, look no further than the leaderships of the big property developers and landlord companies

Working in the transport industry have just enjoyed a 6.1% wage increase honouring our enterprise bargaining agreement.

The power of responsible union bargaining on behalf of its members.

I would go further. Under Australia’s conditions of oligopoly what is needed to drive productivity is to lift wages first, thus forcing the oligopolies to seek expanded markets and/or invest for increased productivity to maintain profits. To get that to also flow to consumer prices you will be aided by aggressive market regulation. Centralised wage fixing was an important driver of rises in productivity and higher standards of living all through Australia’s history but the brilliant ignoramus Keating drank the Stone Kool-aid and dismantled most of it.