An Australian YouTuber is claiming a tax deduction for buying an expensive video game weapon in what might be the first documented example of a tax write-off for a digital collectible item.

elmaxo is an online gaming creator with nearly 200,000 YouTube subscribers who makes videos about popular online first person shooter game Team Fortress 2. Last month, he shared a 40-minute video about challenging himself to rack up 10,000 kills of other players in seven days.

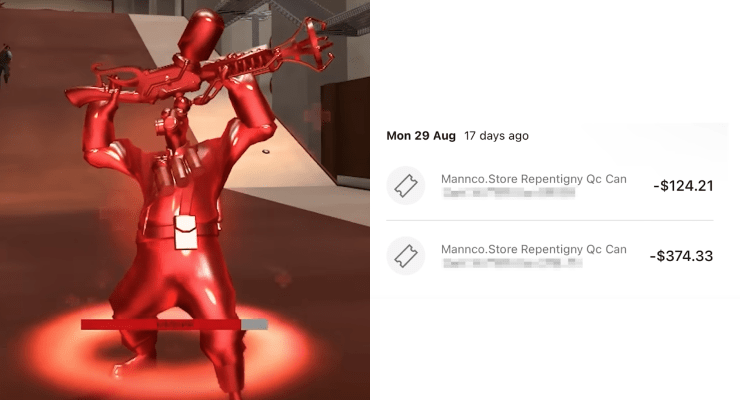

As a way of keeping track of his progress, elmaxo purchased a version of the game’s ray guy weapon, called a phlogistinator, with a “strange” item quality. Team Fortress 2 has a game mechanic where weapons can have different item qualities that will change the way they look or work. The strange item quality means the weapon shows a public count of how many kills have been made using it.

Taking it a step further, elmaxo obtained a rare collector version of the weapon — one of fewer than 200 versions of it that exist according to game item statistic tracking website backpack.tf — which cost $498.54. This cost, he explained in the video, was a business expense that he could claim as a tax deduction this year.

“I actually recently created a business in Australia for my YouTube channel, so this little 400 dollar purchase? That’s a tax write-off baby,” he said.

elmaxo told Crikey the idea started as a joke when he told friends about how he was claiming purchases like a new computer, monitor, keyboard and other items used to game, stream and create videos.

“I ran it past my dad who is a financial adviser and I can’t recall the conversation super well but he was sorta 50/50 on it,” he said.

Noting the requirement to record how much of an expense’s use is for business, elmaxo said he’s only used the weapon for the challenge. The Australian YouTuber even named his weapon in-game “Taxation Administration Act 1953” after a federal tax law that he said made it possible to write off the expense. (He subsequently renamed it the “Income Tax Assessment Act 1997” after being informed by an audience member that it was the relevant law.)

A business expense can be claimed as a deduction if it is both directly relevant to earning income and has a receipt or proof of purchase. In 2019, the Australian Tax Office (ATO) released a list of unusual tax deduction claims — including a wedding, Lego sets and beer — which were mostly rejected. In an even stranger claim, a 2003 Federal Court ruling upheld previous decisions allowing convicted heroin dealer Frank La Rosa to claim a deduction for $220,000 stolen during a drug deal, prompting the federal government to change the law to stop people from claiming items used as part of crimes.

elmaxo said he’s going to give the receipt and documentation to his father’s accountant later this year to file his return. He doesn’t have plans to buy any more items to claim but is interested to see how the ATO responds.

“I don’t imagine they’d have any expertise in this area or how the [Team Fortress 2] economy works so I just think it would be funny to test how our government’s institutions deal with a very bizarre type of business expense,” he said.

An ATO spokesperson declined to comment on specific circumstances but stressed to Crikey about the need for a deduction to be directly related to an individual or businesses’ income.

“This means that you can only claim items that are directly connected to earning your income,” they said.

Update: A comment from the ATO spokesperson has been added after publishing.

Opinion from a CPA.

Elmaxo uses the video game equipment & associated software to earn assessable income, and any payments he received from YouTube would be assessable in the circumstances described, so he’ll get the deduction.

The deduction will be limited to the split between personal and work-related use, but in practice, as he’d likely be working on his YouTube channel (nearly) full time, the video game equipment would be 100% deductible.

Hopefully he gets it – content creators work hard and deserve equal treatment under tax rules compared to “traditional” industries.

Be interesting to see where this one goes. Without knowing all the finer details: If the guy earns legitimate income in this way via an Australian registered business and pays tax on it in Australia then in theory he could claim this expense as a business expense. I’ll be curious to read the eventual ATO ruling on it.

If he’s earning income from the activity and he only uses the “gun” as part of that activity, then it is clearly deductible.

Looks like a religion to me, shouldn’t pay tax at all.