Peter Dutton and the radioactive gang of nuclear spruikers in the media seem to think that if only they call for a “mature debate” long enough, small nuclear reactors (SMRs) will just pop into being.

But like any energy source, nuclear power comes with a host of practical challenges that don’t seem to feature in the op-eds and speeches about how SMRs are just around the corner.

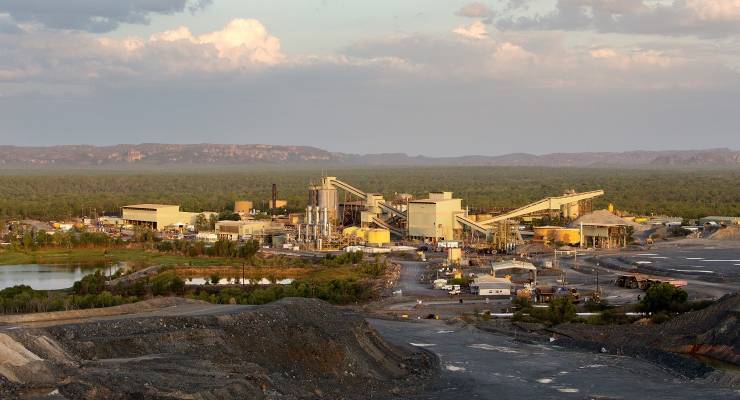

Take, for example, the plight of Energy Resources of Australia (ERA) — the almost wholly owned subsidiary of Rio Tinto that operated the Ranger uranium mine in Kakadu in the Northern Territory from 1980 until 2021, when it was closed and rehabilitation work started.

The 2019 budget for the rehabilitation: $973 million.

In February 2022, as the inadequate nature of the planning and other work on cleaning up the mine became clear, ERA announced the cost would actually be a range of $1.6 to $2.2 billion. And the original finish date of 2028 would be missed, it said.

Wait, we can hear you saying — a nuclear power-related project that went over budget and over schedule? We’re shocked — shocked!

But hang on: ERA now says it expects total costs for the rehabilitation of the Ranger mine to, erm, “materially exceed” its previous estimate. “Materially” in this context means a large amount of money.

The company was supposed to have received a 2022 feasibility study by this month, which would “address the rehabilitation requirements on components where enough certainty can be obtained, including a revised estimated schedule and cost, through to September 2027”. That study will now arrive next month, when ERA will update the market and consult with stakeholders.

So what will the final bill be? The company is “unable to confirm the estimated complete project schedule and total rehabilitation costs at this time, due to a number of uncertainties including the outcome of the final 2022 feasibility study, the outcome of the additional studies and the further work to be undertaken by ERA to verify and attempt to mitigate estimated costs identified in those studies”.

This is the latest in a string of bad news for ERA: in its financial report for the half-year to June, the company revealed that the loss attributable to owners grew tenfold to $331.3 million from $33.6 million. The uranium producer’s revenue from continuing operations slumped to just $13.4 million from $47.7 million.

ERA said the loss in changes in the estimate of rehabilitation provision was $301.6 million for the half (that’s because the rehab cost estimate rose by $368 million in the six months to June, lifting the estimated cost of the work to $2.18 billion, meaning there is very little headroom available for further cost rises).

In April, ERA sought $369 million from shareholders in an issue to which Rio Tinto contributed $319 million. That helped the company’s cash position rise to $823 million at June 30, comprised of “$227 million in cash at bank, $100 million investments in term deposits with maturity dates greater than three months and $496 million of cash held by the Commonwealth government as part of the Ranger Rehabilitation Special Account (Trust Fund). The company has no debt and $125 million in bank guarantees”.

So ERA has cash to fund the rehabilitation, for now. But if the “material” increase in the cost is substantial, to whom will ERA turn? Taxpayers, perhaps?

Late, massively over budget, and reliant on taxpayer subsidies. Sounds like nuclear power to us — small and modular or not.

So if ERA folds, will its responsibilities default to its parent company, or to the taxpayer?

I think the point of a subsidiary company is to limit the liabilities of the parent. Before Ranger was given the go-ahead the Territory government built an all-weather concrete highway to it from the Stuart Hwy, supposedly for tourists but which stopped at the Ranger site. Ranger was always going to be allowed, and the clean-up, of massive toxic ponds behind earth berms, and in the tropics, was always going to be impossible. The downstream wetlands, of huge international importance to bird migrations, as well as tourism, will eventually be poisoned unless the taxpayer plays an ongoing part. Fairly bigtime too. ERA is no friend of the environment – it’s there to make money. Ranger was always a crime – against the locals, against the fabulous country there, against the wildlife, and against the silly taxpayers (like me) who were unable to stop it. It’s just a game, with taxpayers always the losers. And it continues. So vote Green next time. (That’s the solution.)

I am sending this to Peter Dutton for a comment, any odds on a reply?

The tailings dams have leaked millions of litres over decades, so much of Kakadu is already contaminated. The massive tailings require isolation and monitoring for 1000’s of years. The containment of the Magnesium in the downstream flows is probably impossible over the long term.

So, in other words, they aren’t going to clean up after themselves.

Colour me surprised.

SOP for the mining industry. Negotiate an arbitrary rehabilitation bond, at end of economical life sell the mine though a series of companies until it lobs with one with a paid up capital of $2 and directors who cannot be found. PAYE taxpayers put your hands in your pockets again, mugs.

The cost of rehabilitation of Ranger Mine is nothing compared to the enormous impact its uranium has cost the world’s coal industry. Our per capita consumption of electricity is about 1 kW, which only requires the fissioning of 1 g of uranium per year. Of far greater insult to the environment is the equivalent emissions of between five and 10 tons of CO2 from burning coal. That’s per person, per year.

In just its first use in modern reactors, half of one percent of Ranger’s uranium has been fissioned, creating the equivalent of more than 200 years of Australia’s entire electricity production, and averting between 30 and 60 gigatons of CO2 emissions. Very little of the remaining 130,000 tons has so far been recycled, and the US’s coal industry in particular wants to keep it that way. When unidentified voices urge you to obstruct the recycling of nuclear fuel, consider that you would be serving the interests of fossil fuels instead of the environment.

So, have you found a place to store it yet?

It’s my understanding that only a tiny percentage of uranium is fissioned before the rods are “put into storage”(forever). Maybe I’m wrong.

Yes, you are wrong. Or more to the point, you have been villainously misled. Used fuel is easily stored in a corner of the car park until it is taken off for recycling. Getting a hundred times more energy out of nuclear fuel is a major threat to the coal industry – they desperately need you to believe that used fuel is more of a threat to us than the coal it is going to replace. If you are concerned for the environment, you should put your thumbs down to coal, and your thumbs up for nuclear.