Every year, Treasury releases a tax expenditure statement telling us what various tax concessions cost the federal budget. This year’s is the first to feature distributional analysis showing who gets the benefits.

Since its release on February 28, the media has focused on the two most expensive areas: superannuation and housing. The report showed such concessions flow overwhelmingly to those in the highest income brackets. And with bursting super accounts in Labor’s firing line, they have understandably hogged the limelight.

But there are other inequitable and expensive tax breaks which deserve more scrutiny, many of which are also costly, growing and increasingly inequitable.

A new ute on the taxpayer

The next most expensive tax giveaways after super and housing are work-related expenses, which are expected to hit a record $22.6 billion this financial year.

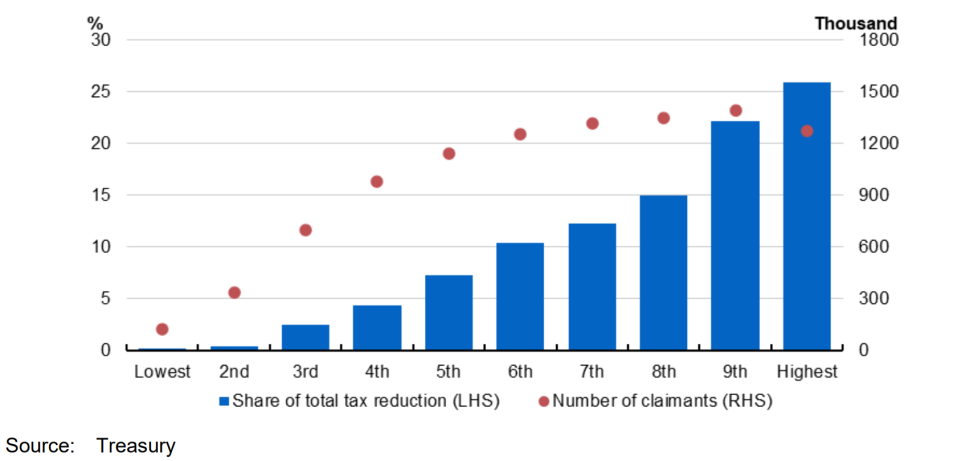

People with higher incomes claim more deductions of higher value, which sees them disproportionately benefit — 86% of work-related tax reduction went to people with above median taxable incomes, and 26% went to the top 10%. Men received 65% of the total tax reductions in this category because they make more claims, of higher value, and have higher incomes than women.

Work-related tax deductions 2019-20

A similar and growing area is asset write-offs and depreciation for businesses. The Morrison government loosening associated rules has supercharged these items. Crikey’s Jason Murphy recently bemoaned the growing presence of ultra-massive utes on our roads. This is, in part, driven by tradies (many of whom operate as small business owners) deducting the cost of a new ute off their tax bill — under Morrison’s rules, many could deduct the whole cost in the same year they purchased it. This new concession alone has catapulted into the top 10 for total cost.

Managing your tax avoidance

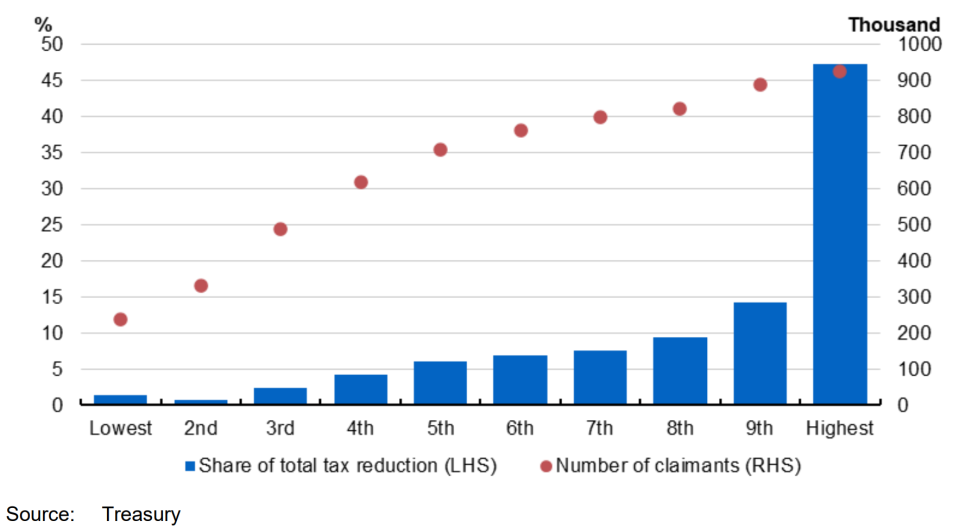

Once your accountant is done shaving off as many automotive monstrosities from your liabilities as possible, you can then deduct the cost of their services. Given the affluent engage the most expensive accountants, almost half of the total tax reduction for this item goes to the top income decile.

Cost of managing tax affairs and other deductions, 2019-20

Labor decided against taking a $3000 cap on such deductions to the 2022 election, after including the proposal in its 2019 platform. But staring down a revenue hole and fresh from a super victory, Treasurer Jim Chalmers should be emboldened to re-pitch the cap.

Another reasonable proposal he ought to resurrect is Labor’s dumped plan to tax family trusts at a minimum rate of 30%. Trust income is taxed at the recipient’s marginal rate, so wealthier people are incentivised to channel money through trusts to their lesser-taxed relatives.

Treasury’s report shows those on the highest tax rates declared the highest amounts of trust income, but the highest number of recipients did not pay tax at all, strengthening concerns it is merely a tax avoidance scheme for the rich.

A spirit of giving (away much-needed revenue)

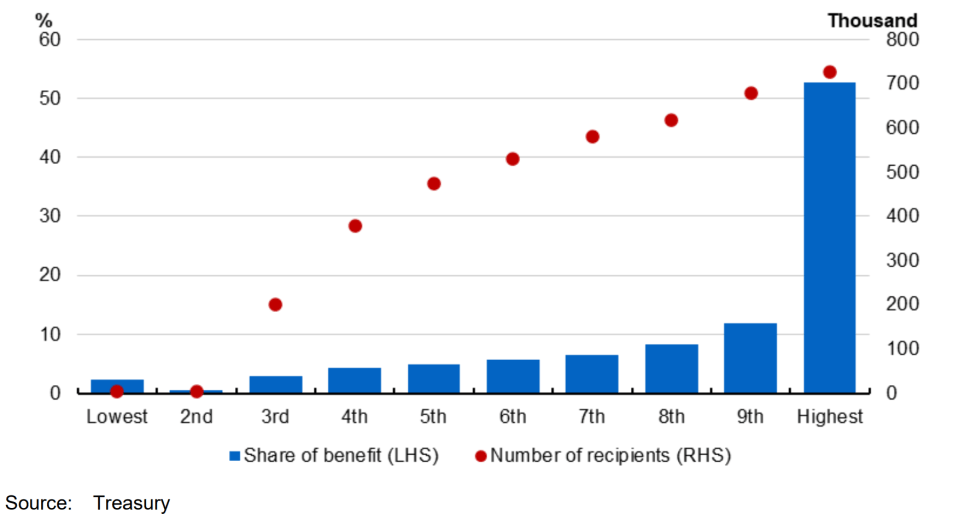

Even relatively benign sounding concessions mostly benefit the wealthy. Deductions for charitable donations, for instance, disproportionately reduce the taxation paid by the richest.

Deductions for gifts and donations, 2019-20

For instance, Gina Rinehart has given millions to tax-deductible gift recipients including conservative think tank the Institute of Public Affairs and the SAS Resources Fund, which pledged to pay the legal fees of returned servicemen caught in the fallout from the Brereton inquiry into alleged SAS war crimes in Afghanistan.

Capping such donations for high earners would not just save taxpayers’ money on questionable ventures, but ensure NGOs aren’t overly reliant on mega-donors.

But surely the GST exemptions for food, health and education items are pro-poor, protecting the least affluent from a regressive tax? Not necessarily. Treasury’s report shows they skew towards the relatively well-off on a dollar-for-dollar basis.

Poorer households spend a higher proportion of their income on food, for instance, so benefit slightly more on an income-equivalised basis. But the forgone revenue still flows disproportionately to richer households, simply because they spend much more on food.

The government wastes a whole lot of money subsidising materially comfortable households’ private health insurance, private school fees and Sunday roasts so that a smaller number of poor households will live marginally cheaper, when it could just compensate those households directly through higher and broader welfare payments.

If Prime Minister Anthony Albanese doesn’t want to plug these holes in our leaky tax bucket one-by-one, he could use a Buffett tax — capping all deductions for high earners to a percentage of their total earnings. He knows this policy well, having proposed it himself at Labor’s 2015 national conference.

Most tax concessions siphon rich people’s money away from public services and those who rely on them — even the well-intentioned ones. The lower and middle classes are better served by alternative assistance. It’s time we deducted concessions from our tax system, so our schools and hospitals get a bigger return.

Quite frankly, I have never heard a persuasive argument for tax deductibility. For anything. Ever. If Government thinks something needs a subsidy then argue for it as a finite quantum in the Federal Budget for all to see. Tax deductibility for landlords, farmers and businesses is effectively uncapped, yet government support for education and cultural needs is strictly limited, must be argued for annually and is often subject to year on year cuts (aka “efficiency dividends”). In a mature economy such as ours, true costs are easily recovered by adjusting pricing to customers who should be prepared to pay in full for the goods and services they want. By abolishing tax deductibility, the Taxation Act would be dramatically simplified and fully half the nation’s accountants could be transitioned to more productive pursuits.

Sadly, your final sentence proposing obsolescence for accountants is the reason it will never happen. Agree with your comments re nil deductions across the board.

I expect they’re a natural outcome to avoiding things like double-taxation (eg: when the states still had income taxes) and so that businesses are taxed only on profits.

There certainly seem some legitimate reasons to have them (and arguably some things that should be deductible but aren’t – eg: transport costs to and from work).

What does this mean ?

Re your final question – not being privy to Hyperion’s thinking, it seems a pretty obvious reference to that Holiest of Holies – price discovery in the Sainted Free Market – standard Adam Smith for freshers.

If a product or service were to accurately reflect the cost to the provider the sales might not be worth the effort.

Without the hidden subsidies of tax breaks paid by the general populace – eg soi-disant FTA broadcasting is anything but when funded by advertisers who recoup the cost from viewers when they are customers.

The same applies to pollution (not the modern C/C ‘carbon’ hysteria) – the true cost is borne by consumers through taxation to remediate.

So if nothing is tax deductible, tax in paid on gross revenue? That’s madness.

Then you’ve never been any thing other than a wage slave.

I agree that there should be a reasonable limit on the purchase or leasing of new vehicles. with deductability limited to a set capital amount, and unable to be claimed for ( say ) 6-7 years.

As to travelling expenses for tradies, something like a 30 -40km from home exclusion should operate. After all, wage slaves can’t deduct anything for costs of transport, but tradies ( for example ) need to carry their tools and equipment every day.

Tax deductibility for your other categories occur because in the main they are input costs; were they not allowed, the nation would go broke in a week, because the tax payable would be measured solely on income.

The case for cracking down on the real lurks, such as family trusts and overseas ‘liabilities’, negative gearing, unearned tax payment of franking credits, etc., etc., is obvious.

I earn a really good income and I have to agree with what you have said in this article, particularly about capping deductions to a percentage of you income if you are a high income earner (is this an amount of earning that is defined somewhere? it should be a tax bracket thing, bring in one at this level and index it with inflation). I think a maximum of 5% deductions should be sufficient. If you only do something that attracts a deduction (such as charitable deductions) for the tax deduction, you are doing it for the wrong reasons.

Work deductions are particularly unfathomable, if you need items to run your business, then buy it and don’t expect a handout from the government for it, it should be just the cost of doing business. The only exception I can see that may be legitmate is a deduction on your business income for genuine R&D expenses. These types of expenses should not be assumed to be legitimate until they have been approved by an independent body that is well funded.

Paying your accountant a lot of money just screams that you are rorting (or trying to rort) the system, so the limit the amount or remove this item from the eligible deduction type. I have also always thought family trusts are a tax dodge (from the few families I know who have them) and that is the only reason they are set up. Tax them as if they were a business based on all income/revenue/earnings with no deductions allowed at all, and tax each recipient with income tax too.

I think the government really needs to focus on housing taxes as their next priority. Eliminate negative gearing – phase it out over 5 years if need be, but it is a rort that needs to go along with the capital gains tax deduction on all property that is not your primary residence. All property that is not your primary residence should have no deductability at all, either while you have it or when you sell it. I find these types of deductions quite nauseous and know several people who have financially come unstuck as they were trying to ride the property gravy train for tax deductability and overextended.

I understand that your primary residence is treated differently as you generally buy a new residence with the proceeds. Although if they want mobility and people to move into different housing at different stages of their life, the regressive tax called stamp duty needs to be abolished Australia wide. An annual land tax could easlily replace it and it makes housing more affordable to purchase and make it cheaper to move. I believe this was supposed to be a feature of the original GST roll-out, but was never enforced.

Thank you Bronwyn. I am a high income earner and agree with everything you have said! Negative gearing is going to be tricky and we need a transition plan – maybe grandfathering and a limit to the number or value of properties owned.

We also need more taxing of wealth rather than just income. The move from stamp duty to land tax is a step in the right direction. The Canberra model is universal and much better than NSW.

I agree with both comments.

Decades of negative gearing and capital gains tax deductions on residential property have led to the current situation in the housing market. Those tax concessions converted a market for shelter into a market for investments and wealth creation. A market that has failed to provide sufficient housing for the population. That is the definition of market failure!

Negative gearing should be only available on new builds, with a limit per investor, and no capital gains tax deduction available on residential investment property.

Any time these issues are discussed there is an immediate chorus of class warfare that is intended to shut down debate, scare politicians, and maintain the status quo.

Negative Gearing and the CGT discount are not the underlying problems, though they certainly exacerbate the consequences.

Neither would be anywhere near as big an issue without the enormous property bubble. The drivers of this are a) artificially constrained supply (mostly developer land banking), b) loose lending standards (mostly bank deregulation) and c) supercharged demand (mostly immigration).

NG and CGT are the symptoms, not the illness.

Australian “Banks” are just glorified Building Societies…………

…….their sole business model revolves around Real Property.

Which reveals the weakness in their game plan – it requires ever-increasing property prices.

Their method of assuring this is that they appoint the valuers who justify the Bank’s price assessments.

Naturally, any valuer whose assessments don’t agree with the Bank’s (his employer) is soon dropped from the authorised panel.

It’s an institutionalized Ponzi scheme.

The logic here is not a “handout”, it’s that a business should be taxed on profits, not revenue (to understand why, consider a business with eg: $10m revenue, $9m operating costs, taxing on $10m rather than $1m is obviously unfair).

The same logic is why deductions for an investment property (ostensibly a “business”) are OK. And why deductions for your primary home are not OK (it’s not a “business”).

The negative gearing problem arises because people are able to deduct the costs of their investment property against their salary income, rather than only against the income generated from the property. I’m not an accountant, I don’t know if this is something people running a business on the side are able to do against their normal salary income, or if they are only allowed to deduct those business expenses from the business revenue.

There are legitimate reasons to have a trust (eg: protecting the family home from a business failure), but yes, there’s certainly an enormous amount of tax dodging done through them as well.

From what little I know I can’t see how any of this can be changed without enormous compromise, disruption and outrage.

Good post.

It was indeed set up by Howard and Costello that negative gearing could be used against personal income, not just business income. That was part of the middle and upper income welfare rorting system by design, intentionally to buy elections.

For that and other rorts, the the Howard government on two separate occasions, was exposed by the IMF as the most profligate in Australia’s history. Each time, judged on its own merits. The mongrels also left Australia with an enormous structural deficit, which has hampered every government since Howard was very deservingly unceremoniously thrown out on his neck in 2007.

Bring back the stocks !

During my working life I was both a sub-contractor and later a prime contractor. In the latter phase, I often needed to use heavy equipment such as mobile cranes and low-loaders, as well as employing 5 – 6 employees and other subbies and expenses that would cost often more than 90% of the income of a viable business.

How do you ‘buy’ that ? And have to pay tax on the gross income ?

Some fine proposals here. After closing tax evasion loopholes for religious entertainment organisations, i’d go after family trusts – both tax theft in anybodies language – and redirect the talent of creative accountants back into more useful social pursuits (via a skills transition program?) like community theatre.

Accountants are like lawyers – they will say anything to please their masters – the ones with the moolah.

The main reason tax law cannot be reformed is that to reduce the (too) many thousands of pages of legislation to something fair &simple would create massive unemployment – amongst the people who matter, lawyers &accountants and the rich who use them to rip-off the rest of us.

It is entirely coincidental that the majority of parliamentarians are failed lawyers and the next largest group being dodgy accountants – hi Barnyard!

The article makes a lot of sense but unfortunately Labor just like the LNP favour the wealthy. It is time Labor just goes for broke, get rid of a raft of deductions, argue for them and if they lose the next election watch LNP blow the budget to smithereens reinstating them all.

The LNP have already blown the budget, as well as a lot of what Australia used to be, to smithereens. We can’t afford for them to have another term until they reform themselves.

Fortunately, we have the Teals and the wisdom of the young to help us in the future.

Every time you create another tax rule you create another margin. And an opportunity to argue the definition at the margin. I remember buying underwater video kit back in the days of wholesale sales tax (remember that) and buying a video light that was decribed as an ‘underwater lamp’ because video equipment attracted a higher rate of tax.

Remember the ridiculous arguments about whether cooked chicken would attract GST depending on whether it was still warm?

You should never be able to reduce your tax based on redefinition of a thing.

Complexity in the tax system (deductions) not only favours those who can afford to manage around it but also costs everyone else.

Remove ALL GST exemptions (food, education etc) AND compensate the poorest by adjusting AND indexing welfare payments to median wage.

Unfortunately its most likely we’d get the former but not the latter.

As Treasurer, PJK proposed a GST (actually VAT but that was too complex for Hawke to sell to caucus) his Option C was predicated on “compensation for the poor being laid on with a trowel” which was never going to happen.

I actually believe in a Universal Basic Income, which would pay every citizen, including rich people pensioners and lower socio-economic groups, an income of lets say around $25k a year (indexed) which would be enough to live on, particularly when shared among a family, and that would be tax-free. Everything else would be taxed progressively. No tax-free allowance like we have now.

This would save heaps of money as you wouldn’t have any compliance costs when it comes to enforcing welfare rules and pension rules which is the majority of the cost for those programmes.

I have a compelling urge, deep in my guts, that suggests that instituting a REAL land tax (harvesting some of the the unearned value that landowners, ESPECIALLY commercial, but including private homeowners like me, accrue from their land) might enable all other taxation to be dropped. ALL other taxation. Now, wouldn’t that be nice?