Back in the days when BRW had a monopoly on publishing an Australian Rich List, the annual event used to generate radio, TV and newspaper coverage across the country. These days its version is barely remarked upon — partly because The Australian has produced a competing version for the past five years.

With no single annual publishing event documenting the movements, the whole exercise has lost focus and consequently neither paper invests anything like what used to occur.

The AFR’s 2023 Rich List was a 32-page magazine inserted inside the regular AFR Magazine, which in Friday’s case came to 92 pages. With 124 pages to play with, you’d hope the depth and breadth of the coverage would be comprehensive. Alas, the standard entries for the top 200 were whittled down to a single paragraph, often amounting to a miserable 12 to 15 words in which nothing particularly material could be conveyed.

Sure, there were breakouts on individual entries but it skewed very Sydney and very old, with the same old names getting written up: Lang Walker, Harry Triguboff, Jack Cowin and pubs mogul Arthur Laundy.

Did we really need a picture of 81-year-old bogan John Singleton sitting on a white grand piano with his bare feet on the keys when the accompanying words did not explain how he’d lifted his wealth from $768 million to $820 million? With six divorces under his belt, “Singo” is probably worth less than half that and shouldn’t even be on the list now that the cut-off is a ridiculous $695 million.

And speaking of people missing the cut-off, the AFR bizarrely gave Sydney crypto spruiker Fred Schebesta a five-page profile, even though it calculated he was worth only $210 million. Why?

The same goes for failed SurfStitch founder Lex Pedersen whose net wealth wouldn’t be much at all but he received a very soft run in the AFR’s Rich List edition because he’s now running a very Sydney luxury car investment scheme. Whatever happened to journalists ending easy PR stories for people with a record of losing money for investors? SurfStitch was a big collapse back in 2017.

Some of the other entries were just plain wrong. The AFR reckons Perth mining mogul Kerry Harmanis got rich selling “Cosmic Nickel” to Xstrata in 2007. It was Jubilee Mines which sold for $3.1 billion, about $500 million of which went to Harmanis.

Other entries were arguably misleading, such as the Costa family wealth being linked to the $1.2 billion ASX-listed Costa Group when the family owns less than 2%.

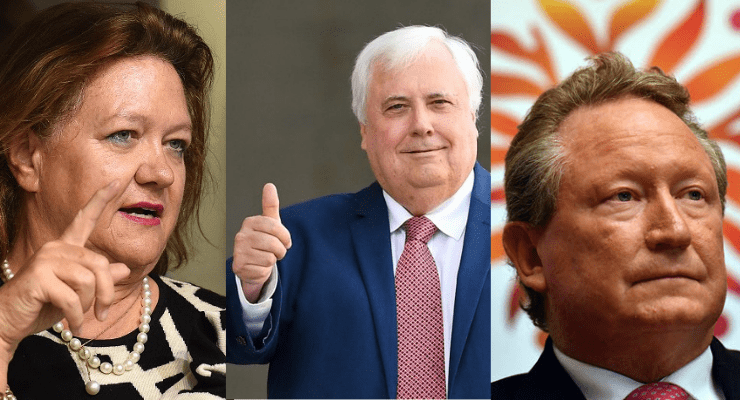

As for the very top of the Rich List, it’s hard to believe that Clive Palmer really lifted his net worth from $19.55 billion to the very precise $23.66 billion this year, purely on the back of Chinese royalties from the Cape Preston iron ore operation.

The Gina Rinehart valuation of $37.41 billion is more believable given that her Hancock Prospecting reported a $5.8 billion net profit in 2021-22. Maybe WA Premier Mark McGowan’s successor should pursue some iron ore royalty increases like the Queensland coalminers copped from a state Labor government last year.

After all, the big three iron ore moguls — Rinehart, Andrew Forrest ($33.29 billion) and Palmer — are together valued at an eye-popping $94.36 billion, while the poor old WA taxpayer is still saddled with circa $30 billion in debt. And that’s before considering Rinehart’s four kids who are collectively valued at an additional $9.74 billion, lifting the Rineharts to $47.15 billion and the big three iron ore families to $104.1 billion.

While the AFR was confident valuing the iron ore miners through to a second decimal place, other valuations seemed more finger in the mouth. Western Sydney property developer Arnold Vitocco was valued at the nicely round figure of $1 billion in 2022, and after another 12 months of digging and analysing his empire was revalued at… $1 billion again this year. Perhaps we need PwC to audit the accuracy of these claims.

Then you had some nice symmetry with Kerr and Judith Neilson, who divorced a few years back. Kerr founded Platinum Asset Management and the AFR cut his wealth by precisely $20 million to $1.24 billion this year. In a remarkable coincidence, his lost $20 million found itself allocated by the AFR to his ex-wife who was boosted by $20 million to $1.43 billion. Together it’s hard to see how the duo together remained worth precisely $2.67 billion two years in a row, particularly given the way Platinum’s share price has tanked in recent years.

It’s too easy to nitpick from the sidelines so we should recognise some good pieces in Friday’s Rich List edition. Chanticleer columnist James Thomson produced an excellent wrap, this who’s who of Queensland island ownership was good fun, and the story of Sam Prince — a Sri Lankan migrant to Canberra who has notched up a $1 billion fortune primarily in franchised Mexican food which all started in the Canberra suburb of Braddon 20 years — was also interesting.

That said, there were far too many once-over-lightly rehashes of past entries, and there is clearly rigour lacking in the valuation process. Since News Corp poached the AFR’s Rich List editor John Stensholt in 2018 to produce a rich list for The Australian, the two national dailies have been broadly comparable in the quality of their effort. The incumbent, the AFR, really should have pulled out all the stops to take it to another level, with the obvious innovation being regular online valuation updates on a dedicated website.

Alas, all those glossy ads from the likes of Chanel, Dior, Paspaley, Audi, Gucci and a range of watch and cruise companies clearly make the once-a-year print offering the better commercial proposition — even if the editorial offering is not moving with the times or providing compelling insights.

Perhaps the public has lost interest because the same predictable names at the top are simply engorged each year.

And perhaps knowing that Newscorpse was involved was enough to have the lists described as fiction?

It all means nothing. Anything in any Murdoch publication runs a high risk of just being made up.

No – its simple maths and the economic of neo libs ; Australia has been sold to off site conglomerated investor companies – the rich owners here are off shore in tax havens leaving no real jobs and the neo lib govt henchmen via big data owners ; their consolidation in logistics, land, production etc have bought out “Australia the company” … People are thinking productivity = domestic per capita ownership are synonymous with this encroaching new feaudalism … wake up Wealthy few still protected – biggest mistake was free trade- ironically all its given us is covid and cartels – opposite of competition and equity – Mike Cannon Brookes the cool new dude or just here to flog our resources to Singporean good ? mm?

I think the article should be distributed free among the homeless.

With maps to their, many, properties.

In the 80s, neolib nuttiness the gullible (seemed to have) believed that they too could one day be in such worthy company.