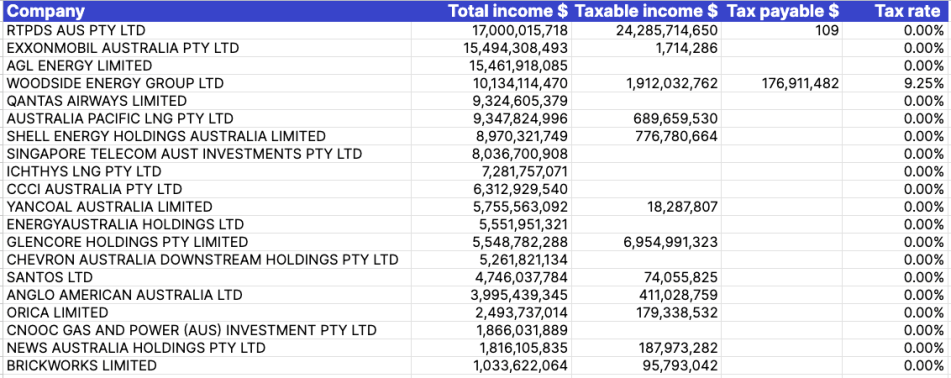

The Murdoch family’s News Corporation and big fossil fuel companies Santos, Woodside, Exxon and Shell all paid little or no income tax in the 2021-22 financial year, the latest tax transparency report from the Australian Taxation Office shows.

Woodside paid $176 million in tax on nearly $2 billion in profit — a tax rate of less than 10%. But its efforts were Herculean compared to fellow climate criminal Santos: that company claimed to have earned just $74 million in profit on $4.7 billion in revenue, and paid zero tax. Another four Santos holding companies earned around $1.1 billion in revenue but paid no tax. Global fossil fuel giant ExxonMobil reckoned it only made a little over $1 million in profit off over $15 billion in revenue from its oil and gas holdings.

Shell paid no tax on a profit of $777 million. The Japanese-owned Ichthys gas project claimed no profit off $7.3 billion in revenue and paid no tax.

Energy company AGL recorded a monster surge in revenue over the previous year, from $10 billion to $15 billion, but made no profit and paid nothing. Competitor EnergyAustralia claimed its $400+ million profit of the year before vanished and it too paid nothing. Origin Energy made $316 million in profit and paid nearly 30% tax on it.

A select list of non-payers shows some of the biggest corporate names in the country:

News Corp, for example, saw an increase in declared profits from $140 million in 2020-21 to $180 million in 2021-22 but the foreign-owned political player continued its long history of paying virtually no tax in Australia: since 2015, the company’s entire operations in Australia, including its once-profitable pay-TV holdings, have paid just $8 million in tax (that was way back in 2015), off many billions of dollars in revenue. It paid no tax this financial year.

The fossil fuel companies did lift their petroleum resource rent tax (PPRT) contributions, from under $1 billion in 2020-21 to $2 billion in 2021-22, less from gas revenue than from a big rise in oil revenue from Bass Strait for Esso and Woodside. Ludicrously, Santos’s PRRT from its Western Australian offshore operations actually fell in 2021-22 from $145 million to $114 million, in contrast to Woodside, which upped its North West Shelf tax payments to $188 million.

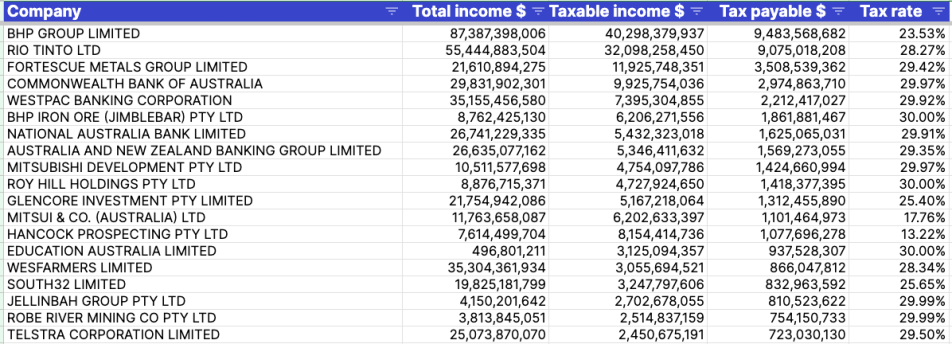

The big mining companies were far more generous: BHP in total paid over $11 billion; Rio Tinto $9 billion (but on over $50 billion in profits across its holdings); Fortescue paid over $3 billion, Gina Rinehart’s companies nearly $2.5 billion (Glencore, on the other hand, continued its tax-dodging ways).

The CBA paid a full freight of ~30% off nearly $10 billion, as did Westpac off $7 billion, NAB off $5.4 billion and ANZ off $5.3 billion — opportunities for tax creativity are limited when you make nearly all of your money from financial services within Australia. The banks may be bastards, but they make a far bigger fiscal contribution to the country than the fossil fuel industries or foreign-owned tax dodger News Corp.

AMENDMENT: A representative of Woodside has contacted Crikey to point out that Woodside’s “Burrup” entities, which it only owns 90% of, and which are thus reported separately, also earned revenue and paid tax:

Putting aside the 90% ownership issue, this means that in total Woodside paid $559 million in income tax off approximately $3.2 billion in profit derived from $13.2 billion in revenue, or a tax rate of around 18%. This is separate from its PRRT payments.

If these mining and resource companies can’t make enough money to pay a decent rate of tax, then it’s high time their social licence to extract and sell our finite sovereign resources needs to be questioned.

How about they are charged a minimum fee for access to the resource, equivalent to (say) 25% of the estimated value and if they happen to have any legitimate tax offsets, that is taken in consideration of their access fee? That level of sovereign compensation is reasonable and think of the money they’d save in crooked tax accountants, employed year long to rort and gouge the Australian nation.

In return for the damage they’ve already done to the environment, the enormous profits they’ve accrued and the disfigurement of Australian politics and civic discourse they are responsible for, it’s still a steal for them.

It’s fossil fuels that don’t pay – BHP, Rio and others pay pretty well. Miners pay the states for access to the resource, on top of federal corporate tax. And it doesn’t seem enough now – but at the time of the first state agreements the investment in railways and ports and mines was huge.

Bernard, I just want to say that I agree with the comments that you make in this article. But more to the point, I particularly want to endorse the ‘straight talking’ that characterized your approach in another article that you wrote in today’s edition of Crikey. If you are in touch with Guy Rundle then please pass on my compliments for his efforts on the same subject also. My reasons for not commenting (or rather, not being able to comment) directly on those articles will be self-evident.

It’s disturbing to note that the nuances of any given conflict are reduced to “for” or “against”. It’s a trend that’s been accelerating in our society and is reflected in all kinds of areas not just the Israel conflict. We saw it during Covid and its aftermath too.

Conflict is what sustains modern media today. Being content is a non-news starter……..on this planet.

Agreed and agreed and also pass on my gratitude to GR too if that’s possible, BK.

Agree we your ongoing comments re ‘that’ subject. Crikey are continuing to publish some outstanding commentary – Keane, Rundle, McGregor and Marlborough. If the price for having access to such high quality journalism on this topic comes at the cost of ‘no comments’, I can live with that.

Yes, TCR, the comments from the Crikey journalists on the Middle East are of a very high quality.

I just do not know why comments on the Middle East are not allowed when there does not seem to be any problem with allowing comments on virtually all other issues. For god’s sake, there is a genocide going on in occupied Gaza at the moment and we are not permitted to remark on that. I know that other sites, such as John Menadue’s Pearls and Irritations do not allow comments on any article (a more consistent approach), whereas, Caitlin Johnstone’s site does permit comments to be made. I am also annoyed that Crikey (as far as I am aware) has not offered any reason for this targeted restriction. I am a simple person who likes direct explanations. I don’t like having to speculate. I want truth and clarity.

I share your frustration re Crikey’s apparent unwillingness to offer an explanation on their decision to prohibit comments on ‘this’ subject.

However, where else would we be able to access the views of Keane /Rundle and some others, if not at Crikey? Caitlin Johnstone publishes via her personal Substack (and her work of late on this topic has been excellent) but she speaks to a like minded readership, as the comments to her articles will attest – she has no-one to appease, least of all editors…

Crikey attempts to speak to a much broader community and as such, have arrived at the decision that real time surveillance of certain comment threads is not viable – for better or worse.

They brought it upon themselves. The IDF needs to eradicate the problem and be done with it.

I suppose they should just allow Israel to drive them off THEIR land in defiance of international law.

Remember, every dead Palestinian creates new supporters of Hamas. One wonders why Israel wants to strengthen Hamas.

“Brought it upon themselves” – I presume you are referring to Israel, who deliberately helped to create Hamas 2 decades ago to divide Palestinians; the then-dominant PLO (Palestine Liberation Organisation) was pushing for a 2-State solution previously agreed by more peaceful Israeli PMs like Rabin, but Netanyahu and his allies wanted to ensure that never came about. Read English-language versions of Israeli newspapers like the high-circulation centrist Yedioth Ahronoth, and you’ll see that about 80% of Israelis want Netanyahu to resign. As recently as 2019 he was openly talking in the Knesset about large amounts of Qatari money funnelled to Hamas directly via Israel, to keep Hamas “quiet”.

not only Gaza related articles, but also the one about the ABC which I thought would be fair game for comment.

Yes, today’s Patrick Marlborough article is a gem.

“Only little people pay tax.” Attributed to Leona Helmsley, New York property developer.

I understand that billionaires use their asset base to borrow against > to pay for their day to day lifestyle > because debt can’t be taxed.

Elon Musk is managing his 200 billion back towards only 100 billion (how to make a small fortune) and apparently can’t afford to pay himself a wage…….EITHER.

What’s the going price for a government these days ?.

Dismaying to see this information. Imagine how Australia’s less fortunate citizens could benefit if dodged taxes were recouped. Or would our less-than-smart governments simply squander it on more submarines et al…

Labor will fix it when th .. oh shugar!

The E.U. Legislation against money laundering and offshore tax havens saw News Ltd enthusiastically back Brexit with the only casualties being SMEs and the millions of employees. The right is constantly proving that they are the masters of hypocrisy and callous self interest…….even if they have to occasionally admit the odd “most humbling day” in the profitable process.