Australia’s big cities have lots of apartments and are getting even more.

Sydney is now just 56% separate homes, according to the most recent data. That is down from 63% in 2001. Most other big capitals are on the same trajectory, as the next chart shows.

Meanwhile, the latest building approvals data shows we plan to build more apartments still.

In Sydney and the ACT a majority of approvals are for dwellings other than separate homes, suggesting that before long Sydney will have separate homes as a minority. Canberra is further from that eventuality but rushing there quickly.

As the next chart shows, 46% of new building approvals in Sydney are for separate homes. That’s unusually high for Sydney, where as much as two-thirds of approvals have been for townhouses and apartments in recent history. Post-2017, and especially since COVID, we are in a little apartment backlash. But it is unlikely to last.

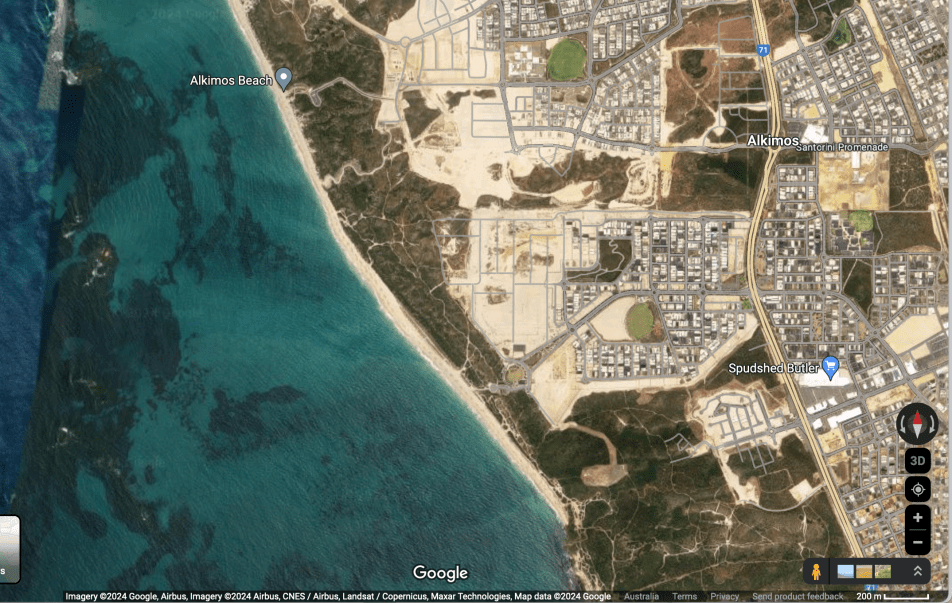

The big cities in Australia are approving lots of apartments and changing their housing mix. (The exceptions are Adelaide and Perth, where they’re approving a higher share of separate houses than exist in the current housing stock. In Perth this is being achieved by just building endless houses along the roads up the coast to the north.)

The increasing abundance of apartments can be seen as good news: houses are getting crazy expensive; people need places to live; building apartments and townhouses means there are homes people might be able to afford to live in. And as we continue to build lightly populated outlying suburbs, we can never reach them all with good frequent public transport, and so our cities become more car-dependent. Even EVs are not as good for the environment as catching a train or walking.

Your author lives in a townhouse whose address features a backslash, indicating that multiple homes have been shoe-horned into a lot that once accommodated only one. Choosing to do so has let me live much closer to a train station than I would otherwise have been able to.

Dwelling prices

But the rise in apartments also means we should cast a very sceptical eye on dwelling price data.

When they say that the average dwelling in Australia once cost $90,000 and now costs $900,000, we need to bear in mind the change in mix. We’re not comparing like with like.

In fact, the price of actual separate houses has risen far in excess of the price of dwellings. That’s not because the actual dwelling on it is appreciating. They don’t: roofs cave in, bricks crack, weatherboards rot, kitchens get outdated and daggy. You need to spend a lot on maintenance and renovations to keep the house itself valuable. No, what appreciates is land.

Land is more in demand now. But land in our cities changes in value because of what’s around it, i.e. cities have changed a lot too. Buy a house in 1985 in Melbourne, you’re buying in a small sleepy city in a country with a ho-hum economy. Today you’re buying in a large, dense, cosmopolitan city, and what used to be the urban fringe is now very much the middle ring of suburbs.

So what we’re buying has changed in two ways. The homes themselves are more likely to be apartments, but the cities they are in have enlarged. Figuring out how that shakes out is a challenge. Are our homes a ripoff that must come crashing down?

The fact land prices keep rising suggests maybe not. But one reason land prices rise is that if you can get at the land under a house you can build multiple dwellings on it. The potential value of land you can subdivide or redevelop is high.

Another reason is that as houses become rarer they are reserved for wealthier people. If the whole income distribution lives in houses, then there are cheaper and more expensive ones. But as houses — especially houses in established suburbs — become rarer, they aren’t so much for students or unemployed people or single parents.

You may have noticed the share house is over; students live in apartments now and their old, falling-down digs have been renovated into a large family home. Competition for that family home comes from families with a pair of income earners and a strong ability to borrow.

This is also why I have come to doubt the idea that house price appreciation will stop any time soon. As long as population growth continues, there will be people looking for somewhere to live. And as long as there’s demand, there will be pressure to turn large blocks of land into multiple homes. That will mean house prices (i.e. land prices) will shoot up. And house prices really are about land.

It’s a cycle where house prices rise under a bidding war from developers and wealthy families, making apartments a more and more realistic option for more people, making sure houses in the established suburbs are under more and more pressure to be redeveloped.

This isn’t a process we can stop by refusing to redevelop: that will only make housing more unaffordable. Given our strong rate of population growth, we are going to need to fit a higher number of people into our existing cities. That’s assuming we don’t go down the Brasilia/Canberra path of creating new centrally planned cities in the middle of a paddock, which would be very environmentally costly and slow to make much difference.

Of course, unaffordable housing is the goal for some people, who see it as their only tool to control population growth. If Australians perceived they had more say in population growth, opposition to development may not be so widespread.

What do you make of the current housing market? Does Australia need to build more apartments to keep up with demand? Let us know your thoughts by writing to letters@crikey.com.au. Please include your full name to be considered for publication. We reserve the right to edit for length and clarity.

About time. The modern detached house suburb is quite awful. Poor transport options, rooves almost touching, small blocks where the backyard is primarily a dog toilet, poorly designed block homes that require continuous air conditioning. Whole suburbs where the houses look the same. No character at all. Trees? well that means leaves and roots, so no. There’s also no sense of community.

Cram and jam.

That’s in the new outer suburbs. The worst of both worlds, and the slums of the future. Far from amenities, yet no garden or outdoor space. The older suburbs are different.

The modern detached house suburb (and similar manifestations in brownfield infill) is largely the product of strangled land supply and skyrocketing land prices.

and our continuing obsession with detached dwellings. Apartments should have been mandated decades ago.

No.

Agree, think we adopted the fossil fuel, auto and building/constructions preferred ‘Chicago Plan’?

Outer suburbs maybe fine forming a family, but one has friends who seem afraid of financially comfortable retirement in the suburbs…. especially if not good at entertaining themselves and/or need to be around people aka work…..

And if you can’t afford roomy detached houses with trees?

That’s the point. Apartments. I’m not sure about the tiny house concept, but if I had a property with yard space in a city, I’d be going the tiny home, or 2, in the backyard.

Population growth is one thing. Massive, unsustainable population growth is what we have, and have had for decades (since Howard started the party rolling). Before that we had sustainable population growth.

Big business loves massive population growth, and that’s why Howard started it, and successive governments of every flavour continued it.

Voters/taxpayers do not benefit from this, instead they get to deal with the fall-out. Every day. Not just in difficulty finding a home they can afford. But when they try to get into a hospital, or enrol their children in childcare or kindergarten. When they try to access overcrowded public transport, or clogged up roads.

And in the future, there’ll be another resource they’re all competing-for: Water.

Why do big businesses love massive population growth?

Surely they can just offshore or automate jobs?

Surely they can just export all of our resources?

Surely they can just allow capital to flow in without people – foreign buyers of property?

Do you think it’s possible that population growth is not some big conspiracy but a fact of living in 2024?

Because it’d be terrible if we were to promote conspiracy theories that feed far right violence against migrants.

Big business likes population growth because it makes the size of the market bigger so they can sell more goods and/or services and therefore make more profit. It is harder to increase your market share by offering a better product or service – it is much easier to increase the size of the population. The more the better.

They already offshore everything they can and automate a fair bit too. You might have had the pleasure of dealing with an overseas call centre or a bot. Rapid population growth distorts supply and demand for labour. Where wages are high, as they were for Pilbara iron ore mine truck and train drivers, companies risk large capital expenditure to automate those jobs. That has now happened. But where wages are kept low by high immigration, those jobs tend not to be automated because there isn’t the incentive to take the capital risk.

Yes, they already do just export all our resources and we get peanuts in royalties in return.

Foreign buyers of property just push up property prices. Not a good idea when there is a housing affordability crisis.

Population growth is due to births out numbering deaths in Australia by about 100,000 per annum at the moment, and a large intake of migrants. It does not have to be a fact of living in 2024. It is a policy choice of the government. Having read the comments section of Crikey for a number of years, I get the sense that the far right violent types aren’t reading it, but I guess we can’t be sure.

But we’ve invented the internet so why do we need all of our customers to move to one country?

Also most modern economies are service based…

Rapid (???) population growth hasn’t reduced wages for top earners.

Maybe the issue is the pay disparity?

Yes, foreign buyers? So they don’t need to be here to buy houses. Again it’s 2024 so we have the internet and stuff and capital knows no borders.

The Australian population has grown at the exact same rate as North Korea’s but at a slower rate as Japan’s and China’s.

There are 8b people in the world, we have an ageing population, 4 workers for every 1 non-worker, that internet thing i keep mentioning, that is the world and Australia in 2024, and by 2050 with no or reduced immigration we’d have 2 workers for every 1 non-worker.

So what’s your actual solution???

Some conspiracy theory that lead to a massacre in Christchurch?

What modern economy is service based? A third world economy?

Australia is no longer a modern economy. We have trashed our manufacturing base.

In Victoria we can’t even dig a tunnel, pave a road, unless we multiply wages by two to three times the standard.

Only small companies (less than 100 employees) are now globally competitive.

Have you ever heard of banking, lawyers, accountants, IT, management consultants, the modern world?

A modern economy doesn’t tend manufacture. It offshores it to China. Which, again, begs the question – why does big business need to go to the trouble of moving people from one part of the world to the other just to make money?

Do you not see how completely bonkers that sounds?

The reason there are more people in Australia is because there are more people in the world. It’s not some conspiracy theory. It’s life. People are life.

Ah, I see, Australia doesn’t have enough bankers, lawyers, accountants, and yes “management consultants” (still not sure what that is).

But don’t our universities train those? Oh, I see we train them for other countries and collect a lot of cash (with the students working in cafes and paying lots of taxes) and the they go back to their homeland and use the internet to force Australia to employ students that want to stay here. Clever.

I always thought we offshored manufacturing it to Amazon. I mean, that’s where I’ll buy my next shifting spanner, (adjustable wrench for the US audience), from.

I am not sure what “management consultants” do either but they seem to be able to work remotely….

Most countries (except hilariously places like Italy and Hungary which have voted for anti-immigrant politicians despite having shrinking populations) have growing populations.

That shouldn’t really surprise anyone in a world of more people which is more interconnected than at any time in human history.

As Italy and Hungary have shown, the best way to reduce your population is to force young people to leave in their droves to find jobs elsewhere!

Australia’s population would also be growing with zero immigration (at about 100-120k/yr).

Most countries have less than replacement TFRs (and have done for generations), but inertia will keep them growing for a while yet.

Japan is a noticeable exception, its population peaked in 2010. Somehow it has managed to maintain some of the highest living standards in the world despite this catastrophe, suggesting that perhaps Italy and Hungary have other problems.

I hope that shifter you’re getting from Mr Bezos’ mail-order catalogue fixes hinges. There’s a lot of them coming loose these days.

Yeh, na, I mainly just use it as a hammer. That’s why I buy a 15 inch one. Never tried it on a loose hinge?…

Yes. Which is why nobody except the voice in your head is actually saying it.

Easy to see why you hate the term straw man so much.

The claim was “Big business likes population growth” and it’s implicit in that ‘Big business’ is somehow the reason we have “population growth”.

I am trying to work out why, in 2024, big business (but seemingly not any small businesses) like population growth so much, and how they are having any affect on it.

You really don’t seem to understand what the term ‘straw man’ means (or how to read full comments given your obsession with selective quoting).

So which part of “more customers” are you struggling with ?

Do you think Australian builders, plumbers, sparkies are going to be selling their services to foreign customers ?

How about Telstra and Optus ? Reckon they sell many mobile phone plans overseas ?

NAB ? Westpac ? How many mortgages on foreign property do you think they sell ?

RACQ ?

Coffee shops, restaurants, personal trainers ?

Do you think many people in other countries are buying retail goods from Bunnings, Myer or Harvey Norman ?

Have you ever looked at how successful Australian businesses that have tried to expand overseas have been (New Zealand excepted) ? It’s not a pretty picture.

Local businesses prefer local customers because they are dominant in local markets and competing in foreign, culturally different, unknown markets is really hard. And if there’s on thing the average Australian business hates doing, it’s anything remotely difficult.

(There are some exceptions to this, but they are, very much, exceptions.)

I reckon I’ve got a decent understanding.

Sorry are builders, plumbers, sparkies “Big Business”?

They’re the ones conspiring with governments to increase the population?

There you go.

Illuminating as always.

The developers subbing them certainly are.

Not that it’s really relevant. Your question was ‘why do businesses need local customers when the internet exists’. The answer is “because competing on a global scale is somewhere between really hard and impossible”.

Nobody is conspiring. Leave the straw man alone.

Your idea of the world is simplistic, and wrong. Not every country on the planet has decided the only road to prosperity is having its population increase by over 300% since 1950 like Australia has. Other small relatively wealthy countries have taken a different path. Look at Sweden, not quite 50% bigger in the same period.

Most countries don’t decide anything when it comes to population because most countries have a limited say over people’s sex lives, and most countries have steered clear of euthanising older populations as a way of managing the ageing process.

China did try the one child policy, and like I said Italy has done a great job of driving young people away.

In 1950 Australia – this vast continent – had a population of 8m (less than the population of London).

I mean on what planet did anyone think the population was not going to increase?

The bigger question is how has Australia mismanaged property so badly that a vast continent of 25m people has the most expensive housing on the planet?

Here’s how:

to name but a few.

But sure adding a few hundred thousand people (most of whom could never dream of buying a home) to the mix is the main concern here.

Where will we get doctors, nurses and child care workers from again?

OK, some very valid points there.

However you left out wages, or more importantly, wages growth. If inflation goes up, while wages go down a person’s dollar has less usable value.

And what is the value of reduced wages? Increased profit. (Andrew McKellar cheers)

How do we keep wages down to increase the profit? Flood the country with immigrants.

Come on down and I’ll introduce you to all our “skilled” migrants working on the packing lines.

“Where will we get doctors, nurses and child care workers from again?”

Maybe we could go back to the olden days when we trained them. You know, before universities were visa factories, (I remember) and before TAFE colleges were gateways to an Uber job. (Andrew McKellar cheers again and shouts the bar.)

Another disingenuous straw man massacre.

Big business likes population growth. Big business makes massive contributions to labor and Liberal parties. When they are in power, Big Business requires value for money spent.

Politicians stopped listening to voters decades ago. It now listens to its political donors, lobby groups, and its own advisers. Voters get three word slogans and campaigns.

We’re talking about massive population growth here, by the way. Your attempts to frame it as some kind of far-right racism seem to have you ignoring that detail.

Pre-Howard, we had sustainable immigration. Late-Howard, he stopped a few thousand asylum-seekers in boats, while quadrupling the annual immigration intake. Our infrastructure has never caught up.

But why do Big Businesses like population growth?

It’s 2024.

Why do I need to import all of my customers to sell to them when we have the internet?

drsmithy said it’s tradies but tradies are not ‘Big Business”.

So what is this mysterious “Big Business” that has not discovered the internet, offshoring, automation, and still operates in the 20th century, that is conspiring with government to make people on the other side of the world have babies and move here?

More customers.

Because it’s easier.

You are hilariously dishonest.

Nobody is saying this except the voice in your head.

I think they like it because it pushes up land prices, which people like them tend to own, and pushes down wages which is not them.

More customers.

If they can, they have.

>50% of population growth in Australia is immigration. Immigration is a policy choice. Something you agreed to last time you tried this straw man on, I seem to recall.

So don’t ?

Nice selective quoting….and a straw man reference….you’re a real thinker.

Have you ever heard of the internet and ecommerce?

It’s a really neat way to find customers anywhere in the world.

But sure in 2024 the easiest way to make money is to make people on the other side of the world have babies and move here.

It is a policy choice – a policy choice based in reality.

It’s reality you home owners have an issue with.

And as a home owner you really are obsessed with commenting on articles on the housing crisis…..

No, we have two drivers of population growth temporary and permanent.

The FIRE and nativist MSM only focuses upon one misdescribed as ‘immigration’, when it’s simply post Covid catch up of international students, backpackers etc. as the ‘nebulous’ NOM net OS migration formula creates short term ‘data noise’ and spikes both border movements and estimated resident population; majority end up departing….

However, the elephant in the room is our own boomer ‘bomb’ and oldies who due to better health are living longer and occupying established property or houses longer, and dominate the above median age vote.

On infrastructure it’s not static and ‘immigrants’ you cite are being falsely blamed by RW MSM for lack of government spending and former also being dog whistled yet ‘net financial contributors’, as they are temporary and most depart with accessing services or infrastructure.

Any infrastructure is dynamic requiring taxpayers for funding, personnel with ongoing maintenance and upgrades; think if you look at hospitals it’s older Australians with more frequent and longer bed stays, but RW talking points nudging to more privatisation and user pays?

Specious, disingenuous, babble.

So, if your couch surfing or living your car, “it’s simply post Covid catch up of international students, backpackers etc.”

or those dam boomers and “oldies” “living longer and occupying established property or houses longer” and their voting power. If that is true (I’m more than skeptical) what do you think is the simpler solution to for the housing challenged? Issue less visas to the former, or euthanase the latter?

Far better data integrity across the board including granular grass roots, that is not filtered by FIRE sector inc., CoreLogic, REI’s, SQM etc, RW MSM and politicians…..and focus on trends, not short term spikes that are used for ‘headline’ guesswork that defies Statistics 101

Death by abbreviation and acronym is too cruel to be a form of euthanasia. All those couch surfers will be pleased to know it is only a short term spike.

Old mate’s idea of “short term” is the ~20-30 years it’ll take all the currently retired oldies to die and vacate their homes.

What part of my mention of “Howard” did you fail to understand?

In the late 90s, John Howard’s government made a big show of stopping asylum seeker boats. At the same time, they quadrupled the yearly immigration intake. We went from sustainable immigration to unsustainable immigration. They also pumped domestic increase with measures such as the baby bonus (Gerry Harvey in particular loved it, saying at the time that he sold a lot of plasma TVs because of it).

Big Business wanted a growing cohort of customers, and they didn’t care what effect that had on the country. They still don’t care. They want growth, as big as possible. As fast as possible.

You have neither defined nor shown any insight into ‘immigration’ (asylum seekers & refugees have little impact), like out RW nativist MSM for LNP agitprop, while pretending to be supportive of consumers vs. big business?

Meanwhile, similarly, you ignore permanent and long term population dynamics….

Perhaps you should show us your insight into immigration. And tie it in with say, business profits.

Anthea is absolutely correct. Ask any lady pregnant at the time the rate at which her various fees went up.

Government splurge means business purge (of tax payer’s cash)

Astounding that the bloke who thinks immigrants don’t use houses or other infrastructure if they’re on temporary visas is accusing someone else of “not showing insight”.

It’s not a given, it’s a deliberate policy choice.

Like poverty. Or homelessness.

Indeed. People who accept high population growth as a fait-accompli are intellectually dishonest and are spivs.

And it’s intellectually honest to deny the reality of more people on the planet and an ageing population.

Glad you’re with such honest intellectuals like Trump and Hanson.

Good grief.

The lame old undergraduate trope of “disagree with rampant population growth and you’re a racist”.

Ad hominem drivel.

If it’s a great idea (high octane population growth) make the case.

Don’t simply label the doubters as Hansonites.

It’s fair, as the original population obsessives always had antipathy towards the other, and especially the lower classes from Malthus, Galton, Grant through to dec. white nationalist John ‘passive eugenics’ Tanton.

Tanton admired the white Oz policy, visited and hosted by SPA; has some colourful quotes see ‘How a network of conservationists and population control activists created the contemporary US anti-immigration movement’ in National Library of Medicine – PubMed (28 May 2105):

‘After leaving ZPG’s leadership, Tanton created additional anti-immigration advocacy groups and built up connections with existing organizations such as the Pioneer Fund (!!). We trace Tanton’s increasingly radical conservative network of anti-immigration advocates, conservationists, and population control activists to the present day’

It’s not something anyone can ‘disagree with’ since it’s a fact.

You can’t disagree with facts.

The world has more people in it. Deal with it.

What you’re doubting is reality.

Notice the way most anti-immigrant politicians are also climate change denialists?

They have difficulties dealing with reality.

Disingenuous, specious, conflationary, rubbish.

And Australia has one of the highest immigration intakes in the world.

Do you have a point?

The desired immigration outcomes of “the doubters” are distinguishable from the Braverman / Trump / Hanson people?

My suggestion is that NOM be capped at ~100k for 5-10 years – or until some key population-related metrics like rental vacancy rates and hospital bed ratios are at acceptable levels – so housing and infrastructure can catch up, and then tied to those metrics going forward. So have your Big Australia if you want, but gotta build it before they come.

Should be lots of low hanging fruit in the “education” space, and dependent visas.

I would also suggest tightening up the “skilled” benchmark as well – eg: must be paid a minimum of 120% the average wage in the relevant sector.

Who does ?

(LOL @ you calling other people “intellectually dishonest”.)

More selective quoting…..

What’s your solution to an ageing population?

Tell us home owner who takes a great interest in blaming immigrants for other people not being able to afford homes like you – the home owner?

You’ll need to be more specific about the problem.

Again, very clear why you don’t like the term straw man.

Selective quoting, calling every argument ‘straw man’ and feigning ignorance…..do you actually want a discussion or just debate for the sake of debating?

What’s your solution to an ageing population?

Answer the question.

We currently have 4 workers for every 1 non-worker without immigration or with reduced immigration that ratio would fall potentially to 2:1.

So what’s your solutjon to that problem?

Where will we get doctors, nurses, police officers, fire fighters, an army, people to fight extreme weather, people to build and maintain infrastructure, people…where will we get people from?

Tell us home owner who takes a great interest in other people’s problems finding homes?

LOL.

I try very hard to have a reasonable discussion, despite your attempts to sabotage it.

Please show your working.

According to this:

https://www.semanticscholar.org/paper/The-impact-of-immigration-on-the-ageing-of-McDonald-Kippen/4a2cfcfb0cef8bfc7b3b765a451589a875ab1536

By 2048:

NOM of 50k reduces the %age of people over 65 by 2.2%.

NOM of 100k reduces the %age of people over 65 by a further 1.6%.

NOM of 150k a further 1.2%.

NOM of 200k a further 1%.

NOM of 250k a further 0.8%.

So the difference in %age points of people over 65, in 2050, with NOM of 50k vs 250k, is… 4%. For net zero migration vs 250k it’s 6.2%.

Now compare & contrast to the countries that are (and have been) functioning fine already with dependency ratios that Australia isn’t forecast to hit for decades.

Then consider the productivity improvements coming from technology.

Then consider the underlying assumptions (people stop working at 65) are already wrong (retirement age now 67, and people are increasingly working past that due to better health in old age).

The whole “aging population problem” is a nothingburger. The biggest concern of the people pretending it is a problem, is not ‘will we have enough workers to do the necessary work’, but ‘will we have enough workers to generate enough income tax to pay for services‘ (because can you even imagine taxing something other than income – the horror ! Plus, of course, MMT).

Same place we do now. Ideally, more people will be doing those things instead of, say, serving coffees or walking dogs.

So in fact we’re actually making the aging population problem worse with higher migration rates. Probably due to family reunion visas allowing migrants to bring over the aging/elderly parents, etc.

Nah, it’s just because the immigrants get old as well.

Family reunion visas are a rounding error in the total intake. Even less than refugees from memory.

Very high immigration only postpones the ageing problem, because you know they age too. And pushes up house prices you seem concerned about. Most peoples concerns are not about immigration per se, but massive levels of it.

Far from it. There might be more people on the planet. Should we just get all 8 billion to move in and leave the rest of the planet to nature? If you say no, think about the reasons why, then keep going.

Using migration to pump a population due to an aging one is a Ponzie scheme because migrants also age. We need to be smarter to get through the demographic bulge.

Never treat the youth with such contempt. They deserve so much better.

I am a young person.

It’s older home owners who seem to treat young people with contempt by sitting on all of the property and blaming immigrants….

It’s interesting how, during the worst of covid, a view came through from some “young people” that mitigation measures were excessive because “it only killed old people”, and from that came the even more interesting sentiment that now young people could get their houses.

At what point should older people remove themselves from their homes so that young people can have them?

Maybe older people could stop using the equity in their homes to buy investment properties???

I personally have been outbid at auctions by pensioners.

Me, a working person on a high income, can’t afford a property, and pensioners can afford another property.

There is no issue with supply in this country, there is no shortage of houses. If there was then people wouldn’t be buying multiple properties. The issue in this country is vast intergenerational inequality.

This is not a dig. It’s pure coincidence. It just happens that people over say 50 happened to be able to buy properties when Australia and the world had a smaller population. And then through no fault of anybody’s the population grew – people lived longer (great) and more people moved here (also great). This population growth (and an unfortunate tendency by that generation to vote for neo-liberalist parties who turned property into investment vehicles) lead to a situation where we have people who have won the lottery multiple times.

Seriously if a person bought a home in say the 70s for say $100k and that home is now worth say $2m. Well done them.

There doesn’t need to be this great inter-generational divide but there does need to be some acknowledgment of the sheer luck that people over 50 have had (in general, not all, women in their 50s are amongst the fastest growing group of homeless people).

And what we can’t have is that generation blaming other people (i.e. newly arrived immigrants, most of whom will never be able to afford a home) for the current housing crisis.

People buy multiple TVs all the time.

TVs are still cheap (and getting cheaper).

Because there’s enough supply.

(Substitute cars if you prefer.)

You get rising prices from supply shortages. There are other factors at play as well, obviously (eg: loose credit, land banking), but the underpinning fundamental cause is shortage.

If you read Alan Kohler’s excellent Quarterly Essay he correctly identifies the CAUSE of this inequality. Namely the changes to tax concessions which made property into an investment (halving of CGT and negative gearing) and high migration; which keeps a floor under prices due to keeping demand high.

No-one who is honest about the situation is blaming migrants. But migrants have become a tool in the hands of the wealthy to further their objectives. Keeping wages low, keeping the service economy going, and keeping asset prices high.

As a young person, who would benefit from the changes to macro-economic conditions if migration was reduced you should be at the picket line.

Seriously if a person bought a home in say the 70s for say $100k and that home is now worth say $2m. Well done them.

I bought mine in 1980 for 14 thousand dollars. It’s now worth around a million…. but….. If I sold it I’d still need to live somewhere. There’s no 14,000 dollar houses around now.

Housing ain’t an investment, it’s somewhere to live.

There were indeed some weird views that came through during the worst of covid.

“People who accept high population growth as a fait-accompli are intellectually dishonest and are spivs”. The world’s population is growing a little under 1% a year, despite reductions in China. That’s an intellectually honest fact. Australians already here do not want their population to grow at what they define “a high rate”. Also, an intellectually honest fact. I’ve no idea what too high a rate is, but will ignore the views of anyone who uses unquantified or unsupported adjectives like “overcrowded”. But they will beat me in the ballot box. Intellectually honest fact?

Yeah to deal with the ageing population they could instead incentivise more women to have babies.

Breed for Australia.

What do you reckon?

We could launch it on Australia Day.

How would that help ? By the time they were old enough to be useful, the “aging population” would be the “dead population”.

You’re really not a solutions man are you?

Well, you certainly are quite young, aren’t you?

You don’t remember, when the Howard government quietly increased the immigration quotas, they also introduced a middle-class welfare measure called The Baby Bonus, with the then-treasurer telling women to have “one for mum, one for dad, and one for the country”.

In fairness to Howard, he thought the population would reach 25m by 2050!

Look part of the reason we have a growing population is because people are living longer. That’s good news but it also means that we need a working population to support that group.

Ironically voting patterns show that it’s older people who own properties and are not competing with immigrants for jobs, but are relying on immigrants for care and support, who are most concerned about…..immigration.

It was Boomers who voted for Trump, Brexit, One Nation and the Coalition.

Wheras of course, there are younger people who are being priced out of rentals and homes, facing greater competition for low wage jobs etc, who seem to be quite in favour of it for weird reasons.

Australia’s population was about 6 million in 1923, 13 million in 1973. It’s about 27 million now. Since before Howard’s time.

Indeed. And if the population had been 14 million in 2021 and 27 million today, your statement would still be true. Do you think the outcomes would be the same ?

Australia grew by ~5m people between 1973 and 1998, and by ~8m people between 1998 and 2023 (~1m between 2021 and 2023 !).

That’s the problem with averages.

We could always start practicing first.

There were once sufficient houses. Now there are not. We don’t have fewer houses than previously & our natural population growth is near negative; so the shortfall is undeniably because we import people faster than we produce houses.

The Federal government is addicted to growing GDP through immigration; simply because “growth is good”. No other country in the world is deliberately stupid enough to go down this path to hell. They know infrastructure/capita costs exceed the revenue generated, so supply of infrastructure & services deteriorates while private wealth grows. Happily, this flaw this does not impact GDP, and more happily the obligation to provide infrastructure & services is mainly a state responsibility, so the blame can always be shifted downwards.

We’re gradually becoming worst in OECD at nearly everything that government is expected to provide to citizens – primarily because of demand exceeding supply. Governments at every level contort themselves arguing why failure to deliver is caused by various externalities when manifestly there are more people than services available, & the plan is to go on increasing that gap.

On that basis; Australian health, housing, education, transport & welfare services must inevitably continue to decline in quality.

And the home-owners’ club will become an exclusive one only the very wealthy can join. That is the only possible outcome.

Canada and New Zealand are also doing it.

At least the Canadians have stopped using Housing for money laundering.

And the Kiwis, … have an NBN that works.

For this to stand you need to show evidence, or you are not looking too hard e.g. EU, Anglosphere etc. ‘no other country in the world is deliberately stupid enough to go down this path to hell’?

Being used as a dog whistle vs. ALP government.

Like obsessions around the faux ‘degrowth’ model, it’s not about immigrants, but anyone outside the 1%; any potential upward financial and social mobility precluded whether citizen or immigrant, with RW MSM willing on return to power, then a permanent QLD LNP (in their dreams aka GOP/Tories) for ‘quiet Australians’.

LOL. That’s what we tell you every time you try to pretend it is about immigrants.

Yes. You are what some people describe as a “useful idiot” in this project.

What a word salad of utter meaninglessness.

Pretty sure that poster is a bot as “…a word salad of utter meaninglessness.” is all it ever produces – various slabs of verbiage seem to be on a hot key and recycled in random sequences, no matter the topic.

It’s a mystery why DrS wastes so much effort responding.

I really enjoyed a history/architectural tour of Bratislava I did last year. Showing us a brutalist communist-era apartment building that had been tarted up, the guide told us why this type of apartment is very much in demand, and slipped in an incidental bit of info: “… but every tennant will tell you their worst day of the year is the day of the annual tennants meeting.”

If you looked hard enough, you might find an apartment built as well as one of those soviet era beauties in Austraia, but you’re less likely to find one where all your neighbours are easy to get a long with. And you’re cheek by jowl with them. From chain smoking or burning the chops on the balcony below you, to not breaking down huge boxes before stuffing them into the recycling bin, along with the reeking sardine cans that haven’t been rinsed out, to sharing the sound of the slow deterioration of a relationship, to arguing about whether the hall carpet needs replacing, apartment living comes with big globs of being inconvenienced and conflict. You can keep it.

You use some very significant phrases, Jason:

“As long as population growth continues, there will be people looking for somewhere to live”.

Spot on, Jason. More people equals more demand. Seems as plain as the nose on your face, but many people just don’t seem to get it.

“If Australians perceived they had more say in population growth, opposition to development may not be so widespread”.

True. To give us the perception we have a say in Australia’s population growth, how about a postal plebiscite, similar to the successful gay marriage plebiscite, asking us what level of migration we’d like? (Given that natural population increase, births minus deaths, is currently about 108,000)

Given our strong rate of population growth, we are going to need to fit a higher number of people into our existing cities.

If the plebescite doesn’t fix this problem, we’ll just have to keep cramming people in. Going down the Canberra/Brasilia route won’t work. Canberra has every facility you could possibly want, but people don’t want to live there because it’s stinking hot in summer, freezing cold in winter, and housing is about as unaffordable as anywhere else.

This sentence struck me too:

If Australians perceived they had more say in population growth, opposition to development may not be so widespread.

Obviously, without the breakneck speed of population growth, there’d be no need for breakneck development. Who would be the winners and losers?

I read it as an apology for population growth, that the poor misguided puntertariat opposes growth because it doesn’t understand, but if it thought it was being consulted, it’d be fine with it.

Which is condescending, and in fact if more people understood how much unsustainable population growth has impacted their daily lives, they might be pretty angry about it.

Well I find your comment condescending and patronising by presuming you have some insight into all things ‘population growth’ and suggesting that it’s wrong, as is anyone who supports immigration? Of course, like SPA no plausible &/or detailed ‘solution’ is offered?

I said “unsustainable population growth”. Not, as you put it, “population growth”.

And then you dragged in “immigration”.

Not “unsustainable immigration”.

These are different concepts. Go and have a little think.

Or is it simpler to throw labels than to come up with an actual argument?

You are really splitting hairs and gaslighting now; reminiscent of SPA’s preferred media and demographer’s word games and utterances ‘I’m not against ‘immigrants*’, but….’, has also contributed to Tanton’s journal TSCP

Why speak of ‘concepts’, then avoid defining ‘concepts’? That’s right, it’s easier to confuse and muddy the water….?

Just sublime.

I genuinely cannot tell if you’re serious, or masterfully trolling. Poe’s law writ large.

Sorry how is a random person expected to know the carrying capacity for an entire continent?

What else should we get a say in?

Interest rates?

Put it to a vote?

Let’s all vote on Australia’s Defence Budget.

What do you reckon?

I think we should all get a say on street lamps. We should be able to decide how many street lamps there are in Australia. There’s far too many street lamps.

With respect to street lamps, I vote one per socket. Pref low wattage LED. What to do about the gaslights I’ll leave to you.

Like what you did there!

Said random person should educate themselves by reading various scientific literature. All which have said that we are exceeding the carrying capacity of this land given our semi-aridity, water flows, loss of biodiversity and deforestation etc.

Why would they need to ?

The question is whether they think growth is too fast, not what the hypothetical maximum is.

Especially when ‘carry capacity’ has some very negative connotations… and is faux environmental science with a whiff of eugenics.

According to Pearce in ‘The Coming Population Crash’ (pp 186-7, 2010), in the US The Carrying Capacity Network (CCN) had people inc. WWF’s Lovejoy, Tanton linked Herman Daly (‘Degrowth’ or Steady State), entomologist (insect expert) David Pimental and ‘ethnic separatist’ Virginia Abernathy. The latter in 2004 presented to Council for Conservative Citizens ‘advocating against minorities and racial integration’ and many of the same at CCN organised anti-immigrant campaign via the (conservation) Sierra Club, as an environmental issue. Pearce adds ‘Nasty stuff, in my view, I am glad they lost’

Further, Tanton was linked and had suggested similar earlier:

‘The basic idea, suggested in a once-secret 1986 memo by anti-immigration leader John Tanton, was to seize the reins of a respected and well-financed liberal group to express immigration restriction arguments that might otherwise draw accusations of racism.’ (SPLC 20 April 2004).

You’re right. Fifty people marooned on a desert island with only a couple of coconut trees is just fate being racist.

New/satellite cities are the better solution, but they need to be managed so that land is cheap, because that’s the way they can grow and attract residents and businesses.

High land prices are an albatross around the economy’s neck at every level, and disastrous for everyone except land holders and banks.

They also need to be accessible. Brisbane has several satellite cities, but there is sweet FA in the way of public transport to them. Toowoomba (abt 100km), you can get 1 of 2 greyhound services per day which will take a couple hours each way. Ipswich (20km from cbd) is 1.5hrs each way on the trains, stopping all stations. Logan (22km from the city) is 1.5hrs each way on 3 (THREE) busses. Caboolture (20km) about an hour each way on the train (though good luck getting anywhere from TWBA station). Sunshine Coast? That’ll be 2hrs on a Greyhound.

Its frankly pathetic.

I agree transport links between cities should be solid (though realistically, HSR likely not economic in Australia due to construction costs).

However, the assumption and objective should be that residents will work locally, and trips to the larger population centre uncommon (eg: for services only available there – large entertainment events, airports, etc).

Australia needs more cities of a few hundred thousand to a million, not millions more people dumped into (primarily) Sydney and Melbourne.

Absolutely would be preferable to have the job in the local area, but then you’ve got your chicken/egg thing. No people move there without access to jobs, no jobs without a population to support it (why Canberra is increasingly recruiting interstate).

Then there are also the social aspects of it, my whole family lives in Brisbane – moving would make me a pariah.

Technology, working changes and remote work should make this relatively easy.

The carrot should be cheap housing. People paid the same as they would be working locally, but able to live somewhere that housing costs ~1/2 as much have a massive incentive to relocate, and their relatively high surplus $$$ would drive creation and investment in local businesses.

Sure, but that’s an individual thing that isn’t really relevant to the population as a whole.

There is a problem with general social support that needs a critical mass of people to fully solve (sports clubs, etc) but I’m confident there are enough people out there prepared to be first movers with the right incentives (see above) that growth could be quite rapid if properly funded and managed (eg: road infrastructure, ideally rail links, water/sewer/electricity, etc).

But all this requires a level of nation building ambition and strategic thinking completely absent from certainly the two big parties, and that’s before considering it goes counter to their general “centralisation” ethos. Very difficult to imagine it ever actually happening.

Yes, with Toowoomba’s high altitude giving it a climate much milder than most of South East Queensland, and all it’s established services, you’d think it’d be a no brainer to put in a decent fast train service from there to Brisbane.

Federal infrastructure minister Catherine King recently pulled the pin on funding a fast train for the Geelong/ Melbourne route. Geelong is a natural as a satelite city because there are so many desirable places to live around it. It’s on Port Phillip and close to the Surf Coast. And while that excellent infrastructure idea has been axed, Melbourne’s much more expensive Suburban Rail Loop, with very questionable economic benefits is going ahead. It makes no sense.

Satellite cities. Catch a train from Cleveland Station in Redlands City. Like Logan, it takes over an hour to get into the city.

The public transport situation in so many places almost dictates you need to own a car, if not two cars (which seems to be the minimum for families these days).

Agree, the old colonial state structure and culture that precludes filling in our regions and making them accessible vs. depopulation and youth migrating to large state capital cities for opportunities where political and commercial elites huddle; this is not so obvious in US or Europe due to more regional expanded councils or state governments.

Europe is more dispersed , but I put it down to settlements there starting much earlier. The trend for a century or so, all over the world, has been people moving to bigger towns and cities.

Yep.

Disagree, just saying ‘population growth’ means nothing but a RW MSM headline, and too often centrist media too, then influences social narratives, while lacking any credible support.

On supposed issues of apartments, you assume that living in detached or semi-detached houses one does not suffer the negative effects of neighbours’ noise, smells, cars etc.?

Meanwhile house meetings or body corporate are part of civil society giving owners and indirectly tenants, a voice and also access to local services and social initiatives?

Near Bratislava i.e. Vienna, there is much well designed public housing and mostly apartments that can be quieter than a house, and rents are cheaper.

Right. The term ‘population growth’ which was used in the article and understood by everyone who read the article “means nothing” except in a headline. I’ve been watching the tennis so the McEnroe cliche seems the only appropriate response. “You can’t be serious”.

Yep. You can get bad neighbours in detached housing situations, but you aren’t forced into collective decison making with them, and you don’t have to reconcile their values, eg:”who cares about recycling!”, with your values: “I really care about recycling”.

You say: “house meetings or body corporate are part of civil society” If you and I were at the same such meeting, I think it would be the worst day of my year, as my Bratislavan guide said.

I didn’t realise the rents were low in Vienna – this means nothing to me. (Kinda irrelevant and apologies to Ultravox)